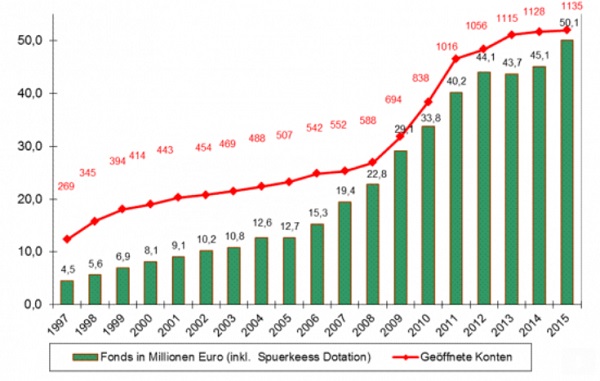

The Alternative Savings (EA) account, jointly created by BCEE and etika, was today announced to have exceeded the symbolic threshold of €50 million in deposits.

The account was first created by the two financial institutions in January 1997, and surpassed the threshold of €50 million deposits on 31 October 2015.

The account, powered by an initial endowment of €1.24 million from the BCEE and supplemented by the savings of 1,135 alternative investors, provided fundings to more than 180 projects and more than 140 borrowers in the Luxembourg region, with all activities supporting either the social, environmental or cultural domain and/or international solidarity in the Grand Duchy and further afield.

"We are proud of this result which has manifested over time the confidence which our investors have placed in us, especially as the savings rate remuneration is the lowest since the creation of the mechanism, which proves the commitment of our investors to an investment product which favours the creation of wealh which is more than purely financial," commented Magali Paulus, President of etika.

92% of alternative investors were individuals, with associations and companies accounting for 6% and 2%, respectively. The alternative savings account experienced a significant increase in the volume of its savings following the 2008 financial crisis, having more than doubled since the bankruptcy of the Lehman Brothers.

"This need to place savings in a product such as ours reflects not only a need for responsibility but also for transparency," added Magali Paulus. "It has been noticed by us, as well as by European social banks, including Gemeinschaftsbank in Germany, Triodos in Belgium and the Nef in France, and has been further confirmed eight years later, showing a trend of European investors which we rejoice in".

etika also reported that its course on global finance machinery, launched in October 2015, has been met with great success and was reflective of the public's continual interest in such matters.

Graph by etika