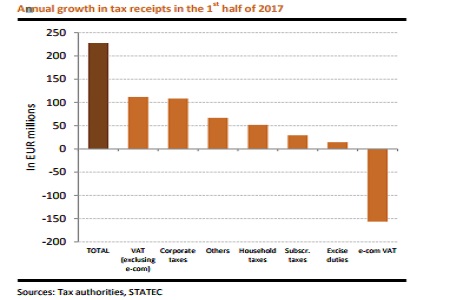

Over the first half of 2017, tax receipts collected by the Luxembourg state increased by 3.2% over one year, amounting to a rise of €230 million.

This rate was lower than that of the two previous years (almost 4%), due to tax incentives relating to the tax reform and a substantial VAT loss on e-commerce. On the other hand, a number of factors boosted tax receipts, such as the wage indexation adjustment, strengthening consumption and the favourable stock market environment.

There has been, however, a slowdown in household taxes due to the tax reform. The reform has slowed down the main growth driver in tax receipts in recent years, namely taxes levied on household income. Up 2.0% (an extra €50 million) over one year after the first half (against a rise of 5.7% in 2016), this category is now the 4th main contributor to growth.

Alongside the effects of tax incentives relating to the tax reform, receipts have suffered from the negative base effect of capital gains tax. After an impressive rise in 2016, after 6 months, this tax is 35% – €80 million – below the level recorded one year ago, but still in line with average receipts for the first halves of 2011-2015.

These shocks were offset, however, by the rise in wages, primarily driven by the wage indexation adjustment in January.