Nordea, the European banking entity present in Luxembourg, today revealed the results of the financial situation of Scandinavia over the last year, as well as its predictions for Nordic GDP future growth.

Nordea reported that the slow recovery of the global economy, despite expansionary monetary policies and reductions in oil prices since last summer, has had impacts on the financial outlook of the Nordics.

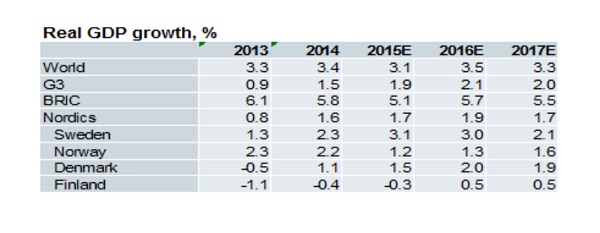

The financial services group states that it expected the modest growth of the global economy to account for a 3.1% increase in world economic GDP in 2015 and 1 3.5% increase for the year after. It reported that in Scandinavia, which are heavily dependent on international trade, it expected a 1.7% growth in 2015 accelerating to 1.9% in 2016, with mixed results in the individual countries of the Nordic region.

Sweden was revealed to be doing well, with a strong domestic demand allowing its economy to grow by 2.5% in recent years. Nordea claimed that evidence suggested the Swedish GDP would increase 3% in both 2015 and 2016, with growth sloqing as expansionary conditions faded. Private and government consumption, as well as investment, were cited as the key driving forces.

By contrast, falling oil prices are set to weaken the growth of the Norwegian economy, with activity in the oil services industries expected to slow in coming years. The mainland economy growth was predicted to be around 1.5% over the next few years.

Denmark is expected to experience a 0.5% economic growth from 1.5% in 2015 to 2.0% in 2016, with rising employment and increasing house prices setting a self-sustaining context for recovery and growth in private consumption.

GDP growth will remain modest for Finland, with no significant recovery of exports expected due to the country's specialisation in producing intermediate and investment goods for companies in contrast to current global trends driven by consumer demand.

Graph by Nordea