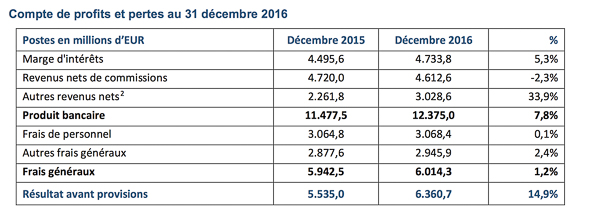

The financial sector regulatory authority, CSSF, has estimated a profit before provisions for the Luxembourg banking sector of €6.36 billion for 2016, a rise of almost 15% on the year before partially reflecting the proceeds from the sale of a significant interest by one of the banks concerned.

Against a backdrop of low or negative interest rates, the interest margin increased by 5.3% over one year, an increase shared by a little more than half of Luxembourg’s credit institutions, and representing 57% of the banking product of the financial centre, combining volume and price effects.

Business volume grew for 64% of Luxembourg’s lending establishments, while 65% succeeded in increasing their average return on assets. A joint effect of these two factors was observed among a thirds of banks. Some banks have also begun to pass on negative interest rates to their institutional clients. Nevertheless, the CSSF says it remains to be noted that the extent of the increase is linked to a limited number of credit institutions.

Net income from commissions decreased by 2.3% year on year. The decline in these revenues, which is largely the result of asset management activities on behalf of private and institutional clients, is linked to a less favourable year-on-year stock market environment, especially for the first half of the year, year. This negative effect could only partly be offset by favourable developments in the financial markets from the third quarter of 2016. The decrease in net commission income affects more than half of banks in Luxembourg.

Other net income increased sharply, up 33.9% compared to the same period last year. By its composition, this position is very volatile and very often influenced by one-off factors specific to a limited number of institutions. This was especially true for 2016 thanks to the sale by one bank of a significant stake which raised its growth from an unadjusted 1.1% to 97% for 2016.

General expenses increased by 1.2% over the year, while personnel costs remained stable at 0.1%, and other general expenses increased by 2.4% year on year. The increase in other general expenses concerns the vast majority of the banks in the financial centre and reflects both investments in new technical infrastructures and the charges to be borne by the banks for their compliance with a regulatory framework with complexity and increased costs .

As a result of the above developments, earnings before provisions increased by 14.9% year on year. Excluding the exceptional effect related to the aforementioned sale, the increase in earnings before provisions would have been limited to 1.5%.

Image: © CSSF