The 11th International Microinsurance Conference on “Driving growth and sustainability – A business case for microinsurance”, will take place from 3 - 5 November 2015 in Casablanca, Morocco.

It will bring together over 400 experts from around 50 countries, representing industry, government and development organisations, to exchange experiences and insights for providing diversified and effective insurance coverage to the world’s low-income people. The conference is organised by the Munich Re Foundation and the Microinsurance Network (based in Luxembourg), in partnership with the Moroccan Federation of Insurance and Reinsurance Associations (FMSAR) and the Centre Mohammed VI de Soutien à la Microfinance Solidaire (CMS).

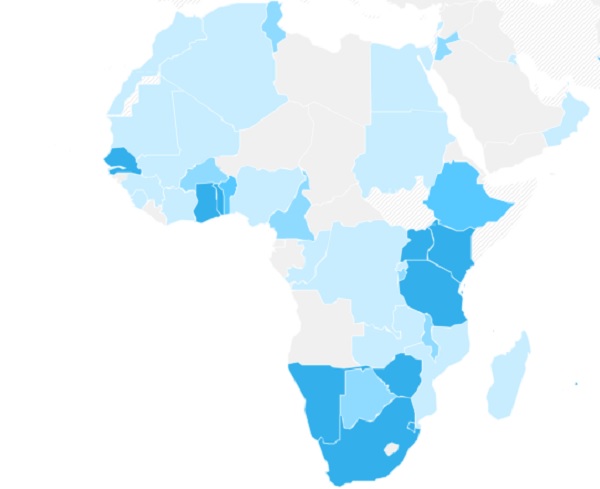

The first day of the conference will see the launch of the preliminary briefing note of the 2015 Landscape of Microinsurance in Africa (2014 data). The study unveils a 30% growth of the microinsurance sector across the African region over a three-year period, with 61.9 m people covered by at least one microinsurance policy by the end of 2014, compared to 44.4 m people in 2011. The total identified microinsurance written premiums in the region amount to almost USD 647 m, up from USD 387 m in 2011, representing a 31% comparable increase. A total coverage ratio of 5.4% of the total population was measured across the African region, up from 4.4% in 2011. This is comparable to the coverage ratio in Asia and Oceania at 4.33% (2012), though still below that in the Latin America and Caribbean region at 7.9% (2013).

“It is great to see indications of a maturing African market with an increasingly diversified coverage”, said Michael J. McCord, chair of the Microinsurance Network. Growth was measured across all product lines, with health, property and agriculture covers growing at a higher rate than life covers. The growth in health covers can be attributed to a few programmes offering hospital cash or hospitalisation covers via Mobile Network Operators (MNOs), reaching some half a million clients. In terms of costs of distribution, the median commissions across channels were just 10% with a weighted average of 17%, with little evidence of the excessive fees seen in Latin America.

CIMA, the regulatory body of 15 West African countries, has been especially active in facilitating market development through enabling microinsurance regulation, with several countries in the region achieving significant coverage ratios, such as Comoros at 8.5%, Togo at 3.5%, Burkina Faso at 2.8%, and Benin at 2.1%. “We are keen to discuss and learn from CIMA’s experience during this year’s conference, taking place in West Africa for the second time”, underlines Dirk Reinhard, chairman of the Conference Steering Committee and vice chairman at the Munich Re Foundation. “Being a financial hub and an entry point to the region, we believe that Morocco can play an important role in market development in the years to come”, he added.

Several microinsurance markets in Africa experienced significant growth over the 2011-2014 period including Ghana, Zambia, and Morocco where coverage ratios reached 29.6%, 22.2% and 1.3% respectively. In the first two, MNOs played an important role in fostering this growth, whilst in the latter, MFIs helped reach the low-income market. Mr Mohamed Hassan Bensalah, president of the FMSAR said “We are proud to host the International Microinsurance Conference in Morocco this year and look forward to exchanging experiences with peers to further support the proliferation of the African microinsurance markets“.