As part of his current trip to Japan, Luxembourg's Finance Minister Pierre Gramegna participated, at the invitation of the OECD and Nikkei, in a conference entitled "BEPS and its implications for Japanese corporations - Luxembourg's approach in a European context", which was held in Tokyo on Friday 12 January 2017.

Pascal Saint-Amans, Director of the Centre for Tax Policy and Administration of the OECD, outlined the follow-up to the organisation's agenda on BEPS, namely the implementation of tools to monitor the implementation of minimum standards, the signing of the multilateral instrument and measures to achieve greater certainty in tax matters (tax certainty), which will be on the agenda of the German G20 presidency. In his speech, he also thanked Luxembourg for its contribution to the working groups that had enabled the adoption of the BEPS action plan.

Minister Gramegna welcomed the work of the OECD in the complex topic of international taxation. He then explained Luxembourg's approach to the implementation of BEPS, which is part of a European context. For Luxembourg, it mainly (but not exclusively) passes through the implementation of the Rulings Exchange Directive and the ATAD Directive, which transposes at Community level the minimum standards of BEPS. In this context, he recalled that it was necessary to ensure that the implementation of the minimum standards was done in an inclusive manner and in compliance with the "level playing field" principle. He stressed in particular the importance of this principle in relation to the need to preserve the competitiveness of the Member States of the European Union in a global context.

According to Kenataro Ogata, Director of the International Division and Tax Treaties at the Ministry of Finance of Japan, and Kazuya Miyakawa, CEO of PWC Japan, the consequences of BEPS will remain measured for Japanese companies. These would consider the implementation of BEPS as a level playing field for major international groups, some of which have in the past been able to take advantage of the legal shortcomings that BEPS actions are now seeking to counter. However, the application of those rules would entail the risk of a greater administrative burden for the undertakings concerned.

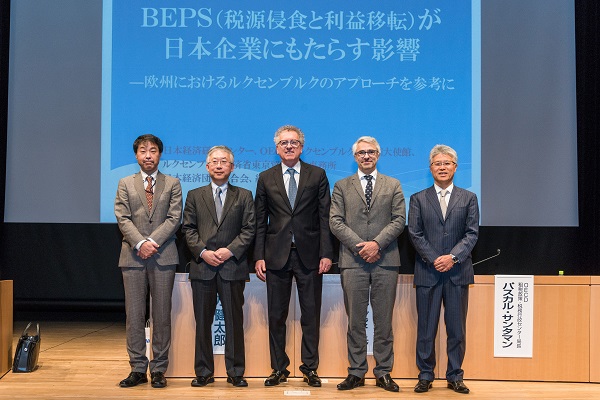

Photo by MFIN (L-R): Shigeru Seno, journalist / panel moderator; Kenataro Ogata, Director of the International Division and Tax Treaties at the Ministry of Finance of Japan; Pierre Gramegna, Luxembourg Finance Minister; Pascal Saint-Amans, Director of the Centre for Tax Policy and Administration of the OECD; Kazuya Miyakawa, CEO of PWC Japan