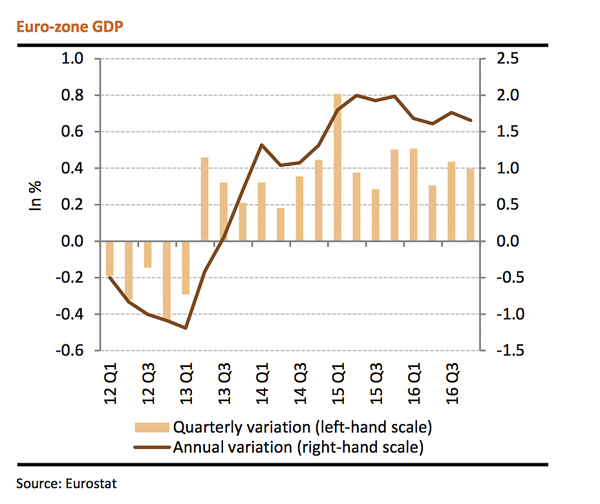

While lower than it could be, GDP within the Euro zone has risen steadily over the last 15 quarters, the longest expansiony phase since the recession kicked in in 2008. Most member states were seeing rises in domestic demand pick up, mainly on the back of household consumption. According to the National Institute for Statistics and Economic Study (STATEC), Luxembourg will likely share in this trend, especially as 2017 pans out.

In Luxembourg, rising car and retail sales in late 2016 should play a large part in the general upturn in GDP. Indicators available suggest that GDP will rebound in figures due to be published on 24 March. The financial sector is also set for a boost from the more favourable stock market performance.

According to flash estimates from Eurostat, Euro-zone GDP rose 0.4% over the fourth quarter of 2016, a result that fell below the expected 0.5%. Germany and France’s economies had a negative as both failed to reach expectations, also rising by 0.4%, while Greece, which was expected to see positive growth, actually contracted by 0.4%.

The main engine of Euro zone growth is still German, with 2016 GDP growth of 2%, almost double that of France, 1.1%, and Italy, 1%.

Spain consolidated its recovery, with GDP rising by 3.2% over 2016, including growth of 0.7% in the final quarter of the year. Record tourist numbers and an improving labour market are proving strong contributing factors in bringing Spain back to pre-crisis levels, and unemployment is on a firm downward trend, falling from 26% in 2013 to around 18% now.

Most Euro zone growth is attributable to a pick up in domestic demand, largely due to rising household consumption linked to the rises in employment. The additional demand is also adding to intra-European trade.

Improvements in other economies are predicted to have positive knock-on effects within the Euro zone too, based on assumptions that budgetary policy in the United States will be more expansive.