The winds are blowing softly on Luxembourg’s economic outlook, buoying consumer confidence, according to the latest report from the National Institute of Statistics and Economic Studies (STATEC).

Luxembourg’s GDP grew by 1.3% over the fourth quarter of 2016, bringing the total growth for the year over the 4% mark, to 4.2%. At the same time, economic expansion continued towards the end of the year, with a better balance between external and domestic demand, while national and European indicators continued to send out very positive signals in early 2017.

Figures from previous years have also been adjusted and restated. Growth in 2014 was revised upward, from 4.7% to 5.6%, while 2015’s was raised to 4.0%, from 3.5% previously recorded.

Overall, much of the stronger growth in recent years is due to revisions of consumption spending by public services (in 2014) and households (in 2015), and to business services. From 2013 to 2015, the pace of economic expansion averaged 4.5% per year, a difference of almost half a percentage point extra compared to the previous figures. 2016’s growth also went above forecasts.

The main contributions to 2016’s fourth quarter growth came from foreign trade, with exports of non-financial services up significantly, and investment which was up 6% over one quarter, +2.5% growth excluding aircraft and satellites, and household consumption, up 1.6% over one quarter, though falling 0.6% in the third quarter. Domestic demand seems to be showing signs of recovery however, thanks to growing labour market resilience.

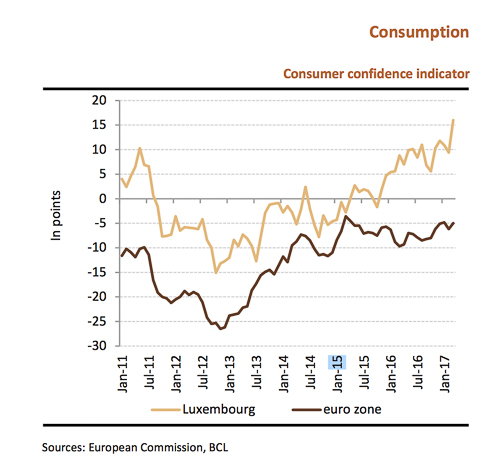

In March 2017, consumer confidence reached its highest level ever.

The improvements cited, no doubt contributed to the healthy performance in the Luxembourg financial sector, whose volume of trade went up almost 7% over one quarter, a level unseen since the end of 2014.

Information and communication services experienced the most rapid growth over the last three years, at least in terms of added value, since in terms of jobs created. In trade and manufacturing, the underlying trend for added value has stabilised in recent quarters. Trade recovered substantially in the last quarter of 2016, but unfortunately manufacturing did not, rising just 0.2%, in line with the disappointing results for industrial output.

National opinion surveys in early 2017 (the latest figures available date from February 2017) continued to send out positive signals. Despite a tense political situation, the European economic climate is also favourable, with opinions up among both businesses and households – a trend that seems set to continue – and the financial markets trended upward over the 1st quarter as a whole.

The PMI composite index for the euro zone (based on purchasing managers’ opinions) stood at 56.7 points in March 2017, a level not seen since early 2011. The trend in this index, which is strongly correlated with euro-zone GDP, points to a significant acceleration in economic growth in the first quarter of 2017, i.e. 0.5-0.6% over one quarter, after +0.4% over the two previous quarters.

This improvement can be seen in both the manufacturing and the services sector. The survey results also show that employment growth is at its highest in ten years, accompanied in some countries and businesses by wage pressures. There is also increased pressure on output prices, linked partly to the rise in commodity prices and the relative weakness of the euro, but also to improving demand, which is allowing some companies to strengthen their pricing power.

The market share for Luxembourg, the leading centre for investment funds in Europe, fell from 26.4% to 26.2% between September and December 2016, although net assets under management grew 2.2%. The same happened in Germany, the Netherlands and Switzerland, which saw their market share drop 0.1 percentage points between September and December. In the United Kingdom, the stabilisation in net assets under management since March 2015 put a halt to the continuous increase in its market share.

On the other hand, Ireland has posted a higher increase in assets under management (+7.2%), growing its market share from 14.2% to 14.7%. The strongest rise for Ireland was in relation to UCITS, where its share rose from 17.7% to 18.2%, and annual net sales higher than other European countries (EUR 117 billion for Ireland compared to EUR 73 billion for Luxembourg).

After rising considerably following the election of Donald Trump, the New York stock market fell in March, with the Dow Jones Industrial Average (DJIA) declining 4.8% since the start of the month. This downturn was due notably to the failure of the Republican party to reach agreement on reforming Obamacare. Nevertheless, the very positive level of the Consumer Confidence Index published by the Conference Board on 28 March reminded market participants that the economic climate remained positive and prompted the Dow Jones to start climbing again.

In the euro zone, the Euro Stoxx 50 has risen 2.2% since the start of the month, up 4.7% since the start of the year, reaching its highest level since December 2015 on 23 March 2017. Although political uncertainties in Europe continue to weigh on the index, the improved outlook for growth and an upturn in inflation have bolstered European share prices. The euro has also gained slightly on the dollar, pushing the exchange rate from 1.05 in early March to 1.09 currently.

Domestic paid employment picked up over the last quarters of 2016, bringing annual average growth to 3.1% in 2016, after 2.6% in 2015. In the last quarter of the year, quarterly growth reached 0.9%, +3.3% year-on-year, a pace not seen since 2008. Unemployment benefited from this momentum and continued to fall, dropping to 6.1% of the working population on average over the first two months of 2017, up from 6.3% in the fourth quarter of 2016.

While financial and business services remained the main sectors for job creation in 2016, with 43% of net jobs created in 2016, much of the acceleration over this period came from transport, construction, hotel and catering and the retail trade. Of the 11,700 net salaried jobs created in Luxembourg in 2016, 40% benefited French cross-border workers and 23% benefited European residents. Luxembourg residents took up 9% of the jobs created.

Apparent labour productivity in Luxembourg continued to rise in 2016. This is defined as the ratio between added value in volume terms and the volume of work, which can be expressed in terms of the number of people or in terms of hours worked or, more prosaically, as the amount of wealth created per unit of work. Productivity was severely affected by the 2008-2009 crisis, rallying only temporarily in 2010-2011, and only really started to recover in 2014. The upward trend was bolstered by productivity gains in information and communication services, financial activities, transport services, business services, and manufacturing (in decreasing order in terms of contribution).

Most euro-zone member states have returned to the productivity levels of before the great recession but Luxembourg has not reached this stage (and neither have Greece, Italy, Austria and Finland).

The inflation rate has gone up considerably in recent months, reaching 1.8% over one year in February compared to just 0.7% in the fourth quarter of 2016. This rise was mostly due to the upswing in oil prices. After making a negative contribution for almost 4 years, energy prices bolstered inflation significantly at the start of the year. On top of this, prices for fresh vegetables are currently soaring, up 25% over one year. In services, many prices were hiked in early 2017 following the wage indexation adjustment. For instance, trends in rates charged by retirement and care homes largely contributed to the rise in inflation, +0.08% between December 2016 and February 2017. However, the "indexation" effect is partially offset by falling prices in mobile telephone services, -0.8%, and air transport -0.05%.

In general, upward pressure on underlying inflation (excluding energy and non-processed food) is still very weak in the euro zone, with the rate remaining stable at a little under 1%.

The confidence indicator for Luxembourg households reached an all-time high in March 2017, at 16 points, well above the medium- to long-term average, which is close to zero. The rise posted in March was noted across all four indicator components, but the most marked improvement was in expectations regarding unemployment trends (although those relating to the financial situation of households and the general economic situation also rose strongly).

According to initial estimates, consumer confidence in the euro zone also improved in March, a trend that is likely to extend into the coming months due to strengthening economic momentum.