A report issued by Luxembourg’s National Institute of Statistics and Economic Studies (STATEC) shows gathering momentum within the EU zone.

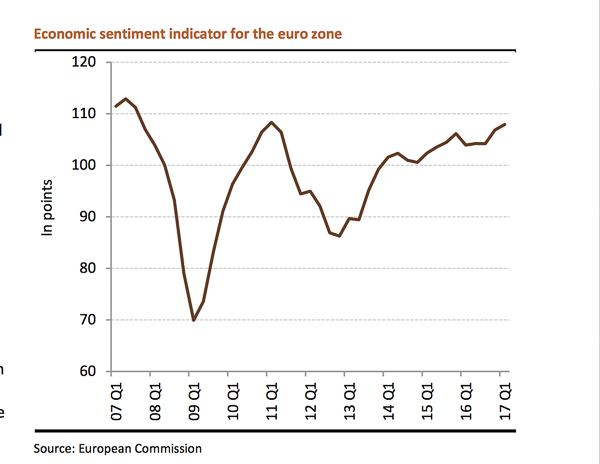

According to the report, sentiment among businesses and consumers in the euro zone strengthened in early 2017, a very positive sign for the short-term cyclical outlook. Other favourable signs at European level – resilience in the financial markets, elimination of public deficits and falling unemployment – point to a buoyant environment in terms of the Luxembourg economy this year say the authors.

The various indicators available for the 1st quarter of 2017 suggest that GDP growth is sustained right across the euro zone (a first estimate will be released on 3 May).

As with the economic sentiment indicator – a composite index derived from five confidence indicators (manufacturing, services, consumer, construction and retail trade) – the opinions garnered in economic surveys show that momentum picked up in the 1st quarter of 2017, on top of an improvement already recorded in late 2016. Furthermore, other opinion surveys already available for April (ZEW and PMI composite indices) continue to rise, a good omen for the 2nd quarter.

However, real (or "hard") data shows more contrasting indications. Manufacturing output has stabilised since last December (a trend that lasted into February), although there has been no notable break in the slightly upward trend that has prevailed since late 2014. On the other hand, output in the construction sector bounced back significantly in February (+6.9% over one month), going well beyond the type of catch-up that could be expected after the very cold January temperatures affected activity (-2.4%). Retail sales also recovered firmly in February (+0.7% over one month), after slipping somewhat over the previous three months. For the moment, the actual data does not indicate any trends as positive and solid as those emerging from the opinion surveys. However, there is no reason to be overly pessimistic. Firstly, the discrepancies between these two types of data sources rarely last long. Secondly, the economic results of services companies, which account for most economic activity in the euro zone and which are showing signs of increasing optimism, are not yet known (except for trade).

There are also other indications that the outlook is improving. For example, the main stock market indices have recovered well in recent months (since December). The political risks linked to upcoming elections in the United States and Europe did not cause any major upset on the markets, although they did lead to a certain wait-and-see attitude on the part of investors (volatility has been falling since mid-2016). The Euro Stoxx 50 index suffered a setback of sorts in mid-April, but it bounced back significantly the day after E. Macron came in first in the 1st round of the French presidential elections (stocks rose some 4% that day). Seen from Luxembourg and its financial sector, this market resilience naturally points to a positive impact on national activity.

The public deficit in Member States has also been falling – reaching 1.4% of GDP for the euro zone as a whole in the 4th quarter of 2016, a level last seen in early 2008 – which suggests that there may be increased room for manoeuvre for more expansionary budgetary policies.

Lastly, the unemployment rate has been falling persistently in most euro zone countries. It recently dropped below its long-term average – 9.7% of the working population since 1995 – not sufficient to generate any significant pressure on prices and wages but nonetheless enough to contribute to the gradual firming up of domestic demand.

Industrial output fell 5.6% over one month in January 2017, a trend that is mostly due to decreases in the iron and steel industry and in the manufacture of machinery and equipment (for this latter category, the drop came after a sharp hike in December).

Output figures have been extremely volatile in recent months, but the underlying trend is downward and indicates that there is a certain disconnect with the results of economic surveys, according to which confidence among manufacturers rose substantially in early 2017. This rise in confidence is due to more optimistic opinions concerning output levels, order books and relatively low stock levels (opinions were a lot more pessimistic as regards recent output trends). In short, manufacturers expect output to increase but this is taking time to show up in results. This disconnect was also evident to a lesser degree in Germany and France in early 2017.

Asking prices for houses and apartments in Luxembourg rose some 7.7% over one year in the 4th quarter of 2016. While some of this sharp increase was due to a base effect (sale prices in late 2015 were relatively weak), the overall trend observed in recent quarters shows that housing prices are still rising very strongly and are even accelerating – up 6.0% over 2016 as a whole, after growing 5.4% in 2015 and 4.4% in 2014. The number of transactions recorded has stabilised, with some 6 300 properties sold per year over the last 3 years.

Asking prices for housing were also up throughout the euro zone (reaching 4.1% over one year in the final quarter of 2016). The highest increases apart from Luxembourg were in the Baltic countries and in Slovenia and Slovakia, Ireland (+7.6%) and Portugal (+7.6% as well), Austria (+7.0%), Germany (+6.7% over the same period) and the Netherlands (+6.4%).

By the end of February 2017, credit institutions had recorded an annual increase of 8.1% in loans granted to non-bank clients (excluding public services). This increase was mainly due to a rise in loans granted to non-financial companies and other financial intermediaries (excluding banks and deposit institutions) all of which rose 9.0%. Financial intermediaries outside the euro zone were the main beneficiaries of this increase (+39.3%). On the household front, mortgages to residents gained 7.4% while consumer credits rose more markedly for non-resident households (+17.1%) than for resident households (+2.4%).

In the euro zone, loans to non-bank clients rose more slowly (+1.0% over one year), driven solely by a slight increase in loans granted to households (+2.1%) while loans to businesses do not as yet show any tangible signs of recovery (just +0.4% over one year).

The results of the latest economic survey among financial services conducted in March 2017 show that confidence rose among all stakeholders in the euro-zone financial sector. The confidence indicator reached its highest level in 6 years, settling at 24 points.

Insurance companies surveyed in the euro zone have noted a positive trend in demand, in employee numbers and in business and expect this trend to continue with improved outlook in terms of profits. The confidence indicator among insurance companies soared to 42 points, its highest level since January 2007. Confidence is also up among banks, which noted a positive trend in demand, in business and in their operating income in the first quarter of 2017. A lower number of banks are concerned that employment may fall in the coming months.

This renewed confidence coincides with a recovery in financial securities on the equity markets since late 2016.

The unemployment rate across the euro zone stood at 9.5% of the working population in February 2017, after peaking at 12.1% in April 2013. According to the European Commission’s winter forecasts, this downward trend is set to continue in 2017 and 2018.

This drop in unemployment is largely influenced by an improved labour market situation in Spain, where the unemployment rate declined from 26.3% in April 2013 to 18% in February 2017, accounting for more than 50% of the decrease in the euro zone. However, the phenomenon is widespread and can be seen in almost all euro zone countries. The only poor relations in this are Italy, Greece and France, where the decrease, if there is one at all, has not set in on a lasting basis. Germany for its part has the lowest unemployment rate in the euro zone, at 3.9% in February 2017, followed by Malta, the Netherlands, Estonia and Austria. Luxembourg, which over recent decades had the lowest unemployment rate in Europe, now only ranks 6th, with unemployment at 6.0% in March 2017.

After bottoming out in September 2016 (0.8% over one year), inflation in services in Luxembourg has risen sharply in recent months, reaching 1.5% in March 2017. It was boosted by the wage adjustment in January 2017, whereas 2016 was marked by extremely low wage inflation (0.4% against over 2% on average over the previous 3 years). This phenomenon considerably moderated price rises in services, which were even below the trend observed in the euro zone (this is very rare historically).

In the euro zone, inflation in services has tended to stabilise recently, with a significant drop in March, but this trend, linked to the calendar effect of Easter, is temporary. The upswing in general inflation across Europe is mainly due to the turnaround in oil prices rather than domestic upward pressure. The more favourable economic climate, and particularly the drop in unemployment, does not as yet seem to be reflected in a pick-up in wages that is capable of sustaining inflation in services.

Over the first quarter of 2017, tax receipts collected by the State rose by 5.9% as compared to the same period in 2016, representing a gain of EUR 200 million. This was partly thanks to low receipts in Q1 2016, which constituted a downturn between two quarters with high tax receipts, and most of it was due to corporate income tax. Nevertheless, based on seasonally adjusted figures, tax receipts have received a boost (+2.7% over one quarter) after stagnating in late 2016.

Alongside the significant contribution made by corporate income tax receipts, which was mainly due to a base effect, taxes levied on households accounted for an increase of EUR 75 million compared to the 1st quarter of 2016. These latter taxes are growing at a similar pace to last year, although this is countered by the rise in wages via automatic index-linking and the tax incentives connected to the tax reform. The drop in VAT receipts (down EUR 38 million) was due to the slump in e-commerce (down EUR 79 million; down 68% following the departure of a major contributor) while other VAT receipts have risen 5.3% over one year.