Taking advantage of CrossLend’s innovative loan securitisation product, the Luxembourg-based bank will continue to expand its presence in the securitisation market, enabling institutional investors to invest into cleared securities backed by pan-European loan products or other eligible assets in multiple currencies.

CEO & Founder of CrossLend, Oliver Schimek, stated “This partnership solidifies our presence in Luxembourg and adds a further stable and long-term partner to our business. BCEE, one of the most prestigious financial institutions in Europe, and of such great importance locally, has again proven to us that we have a great deal of support from the Luxembourg ecosystem – coming after two investments from the Luxembourg Future Fund.”

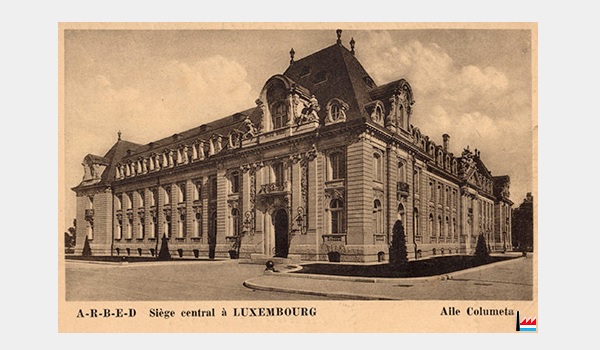

Head of Institutional Relationship Management at BCEE, Alain Uhres, said “Cooperating with CrossLend is yet another way in which we are supporting our institutional clients and Luxembourg’s securitisation market. I think that securitisation is a growing market in Luxembourg and that a legal framework exists ensuring legal certainty, which is of the utmost importance for investors. BCEE has always supported the Luxembourg economy and this most recent collaboration is further evidence of this.”

About CrossLend

CrossLend is a B2B FinTech company with a mission to make the European debt ecosystem more efficient, transparent and profitable. CrossLend provides securitisation as a service, transforming loans into notes on a flexible and transparent basis. CrossLend’s innovative securitisation setup allows investors to build diversified portfolios of loans (via notes)at a pan-European level, with an emphasis on providing risk transparency. On the other side of the coin, loan originators profit from flexible opportunities to scale their lending business – opening up much-needed financing avenues to small and medium-sized businesses across Europe. A win-win-win situation for all. Backed by an array of prestigious equity investors from Europe and the U.S., including Lakestar, CME Ventures and the Luxembourg Future Fund, CrossLend plans to establish a European Debt Exchange. In Germany, CrossLend acts as tied agent of FinTech Group Bank AG within the scope of § 2 para. 10 of the German Banking Act.