Credit: CSSF

Credit: CSSF

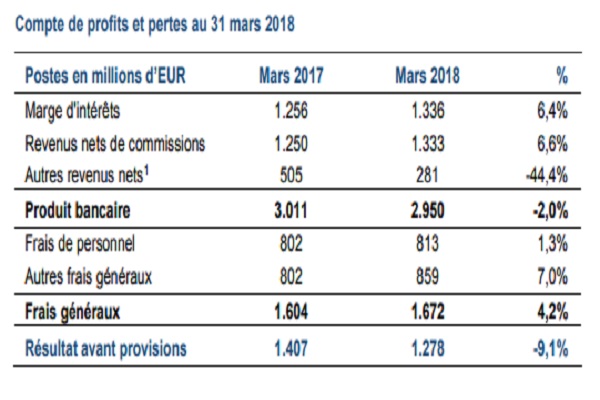

The profit before provisions for the Luxembourg banking sector was €1,278 million as of 31 March 2018.

The CSSF has measured the result before provisions of the banking sector at €1,278 million for the first three months of 2018. Compared with the same period of the 2017 financial year, the result before provisions has thus decreased by 9.1%.

The negative evolution of the result before provisions of credit institutions in Luxembourg during the first three months of 2018 has resulted from two main causes: the continuous increase in general expenses (+4.2%) and the significant reduction (-44.4%) in other net income. These negative effects were partly offset by the positive result achieved on the main banking activities such as banking intermediation and asset management related businesses.

Moreover, the interest margin rose by 6.4% year-on-year. This trend is shared by half of the banks in the financial centre. Meanwhile, an increase in net fee and commission income (+6.6%) was observed for half of the banks. The increase in these revenues, which are largely the result of the asset management business on behalf of private and institutional clients, is directly related to the upward trend of the financial markets and thus to favourable developments of the investment fund industry.

As for other net income, a sharp drop (-44.4%) was observed compared to the same period of the previous year.

Finally, overhead expenses continued to increase (+4.2%) in the first quarter. This increase is mainly related to other overheads (+7%) and to a smaller extent to staff costs (+1.3%).