Credit: KPMG

Credit: KPMG

Luxembourg has adopted legislation to ensure that UK-based asset managers can continue serving their clients in the event of a no-deal Brexit.

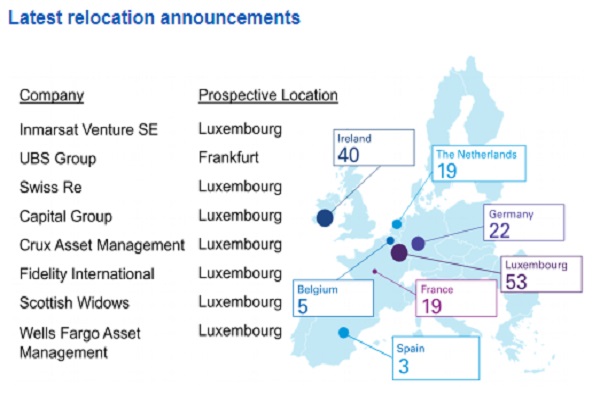

In the context of continued political uncertainty around the UK's decision to withdraw from the European Union, the possibility of a no-deal Brexit is becoming more likely and has sparked fear among businesses. Consequently, some EU governments, including Luxembourg, France, Germany, Italy, the Netherlands and Ireland, have adopted and/or amended national laws to limit the negative impact of a no-deal Brexit. In this way, UK-based asset managers can continue serving their clients regardless of the outcome of Brexit negotiations.

According to the Financial Times, these countries are attempting to mirroe the UK government's so-called temporary permissions regime (TPR), which allows EU asset managers to continue operating within the UK. The TPR concerns EEA firms and funds operating, providing services or marketing funds in the UK and allows them to benefit from it provided they notify the UK regulator(s) by 29 March 2019.

For its part, Luxembourg has announced a draft law that covers the necessary measures that must be taken with respect to the financial sector in the event of a hard or no-deal Brexit. Following the Draft Law N°7401, the Commission de Surveillance du Secteur Financier (CSSF) and the Commissariat aux Assurances (CAA) will be allowed to take certain temporary measures in order to maintain the stability and functioning of the financial markets.

In addition to the MoUs signed between ESMA and UK financial regulators, the EU has urged all companies to start preparing for Britain’s exit from the European Union. In the case of a no-deal scenario and without a transition period, trade relations between the UK and the EU27 trading bloc will fall under the general WTO rules as of 30 March 2019.

This information first appeared in a KPMG report.