According to Statec, Luxembourg's national statistical office, Luxembourg's gross domestic product (GDP) rose in the first quarter 2018, with activity still marked by the good performance of non-financial services.

The prospect of growth close to 4% in 2018 now looks possible with this momentum; however, clouds are piling up above the global economic map, which could affect the external demand addressed to Luxembourg.

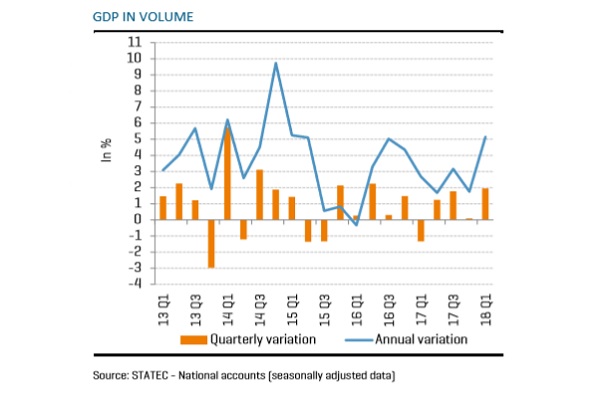

Luxembourg GDP in volume grew 2.0% over one quarter in the 1st quarter of 2018 (+5.1% over one year). This is the best performance posted since the 2nd quarter of 2016, and growth was recorded across almost all economic sectors. Information, communication services and trade contributed the most to this result. Added value in the financial sector stagnated compared to the 4th quarter of 2017 but rose sharply compared to the 1st quarter of 2017 (+6.7%) when it was exceptionally low.

Generally speaking, non-financial services continue to be the main driver of growth. Manufacturing lagged behind slightly (just +0.4% over one quarter) and construction performance (+1.3%) owed much more to companies involved in property development than to those in “traditional” activities (building, civil engineering and specialised activities).

On the expenditure side, household consumption remained favourable. It grew over 3% per annum for the fourth quarter in a row, boosted notably by employment momentum and the effects of the tax reform. Public consumption rose significantly in the 1st quarter (+1.4% over one quarter), with more spending on healthcare and social welfare services among other things. In contrast, external demand (exports less imports) made a negative contribution to GDP growth, partly due to the purchase of a satellite which weighed negatively on imports of goods. Investment also grew alongside this phenomenon (+6.4% over one quarter).

Based on this data, growth acquisition in 2018 stood at a relatively high 3.2%.1 This result should be put in perspective, however, given the volatility of quarterly figures and future revisions2, but it is all the same a positive signal that reinforces the possibility that effective growth could be close to 4% in 2018, in line with the forecast issued by STATEC in early June.