Credit: Statec

Credit: Statec

Statec has released its working paper on "A simple financial accelerator in a standard macro-econometric model", looking at the interactions between real and financial factors in macroeconomic models.

Standard macroeconomic models usually assume perfect capital markets where there is no role for such interactions. This paper shows, however, that the Global Financial Crisis of 2007–2009 highlighted the extent to which fluctuations in asset prices, credit and capital flows can have dramatic impacts on the financial position of households, corporations and sovereign alike, and therefore on the real economy.

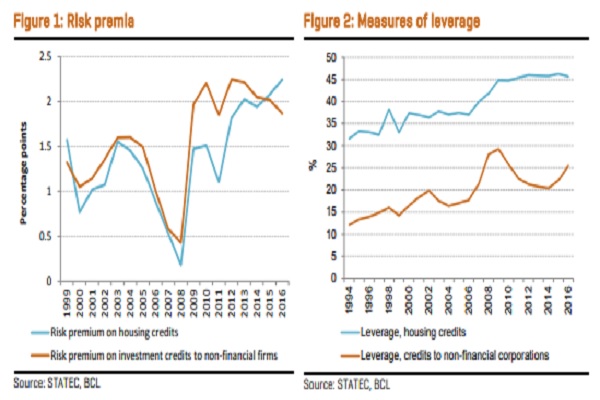

The aim of the paper was to summarise how such interactions work through in a standard estimated macro-econometric model Modux, representing the Luxembourgish economy. The theoretical foundations for the incorporation of these relations were developed over the past three decades. The results showed how recessions impact the lending/borrowing behaviour of banks (mostly in terms of risk taking), the impact of financial frictions (i.e. imperfections) on financial markets and the impact of financial shocks on the real economy resulting from disruptions in financial markets. Those channels have been integrated into Modux, the macro econometric model of STATEC, by means of simple relations, however derived from theory, and based on econometric analysis.

Corresponding work has also been published in two STATEC Working papers in 2016 and 2017), in which the author, Glocker, estimated a financial accelerator mechanism for machinery and capital investment and subsequently for housing investment. The recently published paper therefore aimed to bring both extensions together and to present model simulations in order to illustrate the importance of the (new) transmissions channels between the real economy and the financial sector. For this purpose, shock simulations were undertaken and compared with and without a “financial accelerator”.

The main results of the paper were as follows: whole model simulations with financial accelerator (scenario analysis) remain meaningful, although over a short period only (5 years); comparisons of results with and without a financial accelerator confirm stylised facts found in related research; oscillation (shocks with financial accelerator present more pronounced cycles). One additional finding was that classic public demand multipliers with financial accelerator also increase, in line with a vast literature on the importance of Keynesian multipliers in times of financial stress. Finally, the forecast performance of the financial accelerator model seemed to beat the standard model in terms of dispersion and accuracy in about 75% of the variables tested.

The remainder of the paper entailed a literature review and the theoretical relations that have been estimated, followed by the summarised econometric results.