(L-R): Jean-Francois Jacquet; Stefan Van Geyt; Ilario Attasi, of KBL Luxembourg;

(L-R): Jean-Francois Jacquet; Stefan Van Geyt; Ilario Attasi, of KBL Luxembourg;

On Monday 7 January 2019, KBL Luxembourg unveiled its global investment outlook for 2019; they presented a macroeconomic perspective of world economics.

Jean-Francois Jacquet, Chief Investment Officer at KBL Luxembourg, explained that following a sharp recovery in 2018 from the financial crisis, the global economy is now approaching the end of the current growth cycle, slowing in response to a combination of tighter financial conditions, the end of US stimulus and increased international trade tensions.

At a global level, while US GDP rose significantly in 2018 Q2 and Q3, that in China has showed a steady, yet slight, decrease which is expected to continue over the coming few years. American unemployment figures continue to fall, with the figure now below 4%.

Emerging markets are expected to expand their GDP by 4.5% over the next three years, compared to advanced economies where GDP is expected to fall from 2.4% in 2018 to 1.7% in 2020, dragged down by notably lower growth in the eurozone and in Japan.

In Europe, he emphasised that ongoing political uncertainty continues to exacerbate existing concerns, delay major investment decisions and contribute to expected annual growth below 2%. At the same time, 2019 is not a major election year in most countries worldwide. "That political continuity could contribute to a mood of greater overall stability" he said "which could positively influence jittery financial markets".

On currencies, he expects the US dollar to remain firm against the euro in the first half of 2019, then revers those gains in the following quarters. While the yen appears set to strengthen, sterling's fortunes will be decided when "the ink dries on the Brexit deal".

Some emerging economies such as China and India, will continue to rise in 2019, with Brazil, Russia, etc., expected to contract.

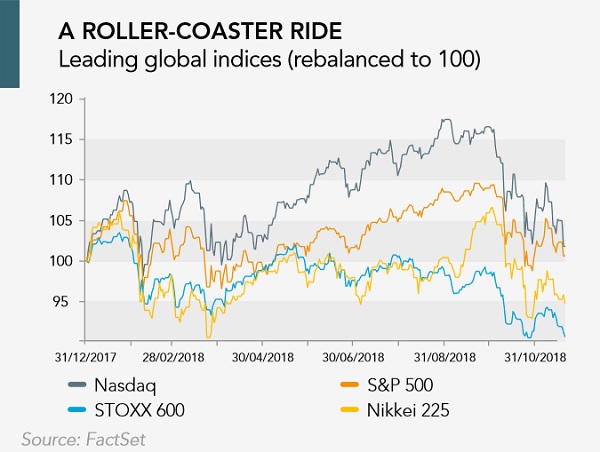

Against this complex macroeconomic backdrop, fixed-income investors will continue to struggle. Global equity markets appear to set record sustained roller-coaster performance, following a tumultuous fourth quarter, generating both nerve-rattling volatility and significant opportunities for steely investors.

Overall, according to Ilario Attasi, Head of Global Research at KBL European Private Bankers (epb), KBL'x Luxembourg parent company, annual earnings growth could potentially reach mid-single digits.

Industry Sector Outlook, Technology, CSR

The presentation also examined spending power across different countries world wide, the effect of obesity in different countries coupled with a chart of countries where its citizens are the most active (China and other Asian countries). Wellness tourism is expected to continue to rise, as well as industries related to medicine, fitness, etc.

On technology, artificial intelligence will continue to grow as its applications continue to expand into new areas all the time. CCTV and other technologies will continue to monitor individuals, with biometric facial recognition technology expected to continue to rise in China and other Asian countries. Technological applications such as Alexa will become more popular, yet these will increase the "Big Brother" effect. Information will continue to be powerful, with companies such as Google and Facebook leading the way. The issue addressed here was "From CCTV cameras to search engines, we live in a world under constant surveillance. Is the end of privacy the inevitable price of technological progress".

On climate change, the world must become more responsible, with investors becoming more aware of corporate strategies regarding the environments, etc., with millennials the most aware of such issues. Responsible investing itself has a long-term role to play in this context, encouraging companies with sustainable policies and CSR initiatives.

Investments: stocks, equities, bonds

The outlook for Japanese stocks remains the most favourable among major regions, reflecting ongoing attractive valuations and solid profit growth. At the same time, Europe looks like the region most likely to suffer from downward earnings, following a disappointing 2018.

Given current market volatility and geopolitical uncertainty, Group Chief Investment Officer, Stefan Van Geyt, explained that diversification has become a key driver of reduced portfolio risk. “With historically low correlation to the performance of both equities and bonds, alternative investments can play an important role in delivering such diversification,” he said, and continued “At the same time, investors need to assess management’s willingness and ability to strategically allocate resources and maintain a long-term competitive advantage. That includes by reviewing relevant environmental, social and governance factors, which are strongly correlated with overall performance. Amidst slowing global growth, the outlook for commodities is mixed. After seesawing in 2018, we expect oil prices to remain under pressure, while gold should shine over the next 12 months.”