On Wednesday 20 December 2023, Luxembourg's Ministry of Finance announced an adaptation of the income tax scale which would provide a first tax relief measure for households, has been approved by the Chamber of Deputies earlier in the day.

Luxembourg's parliament gave the green light to bill no. 8343 on the adaptation of the income tax scale concerning up to four index brackets from 1 January 2024.

At the end of the debates, the Minister of Finance, Gilles Roth, declared: “I am delighted with the vote of the Chamber of Deputies which reflects the desire of this government to sustainably reduce the tax burden on households which will benefit also to the economy in general.”

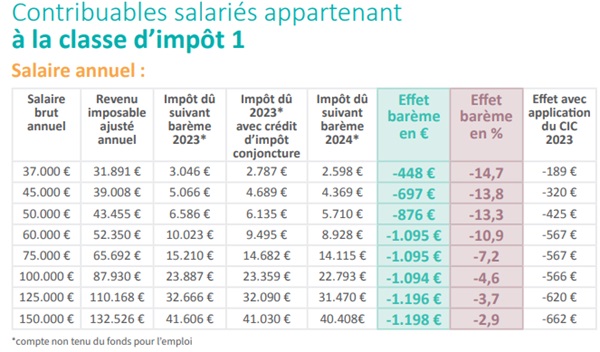

Concretely, the entry into force of the new scale on 1 January 2024 means, for example, for a taxpayer in tax class 1 with an annual gross salary of €75,000, an annual net gain of €1,095 in 2024. Taking taking into account the economic tax credit (CIC) applicable in 2023, the annual gain amounts to €567.

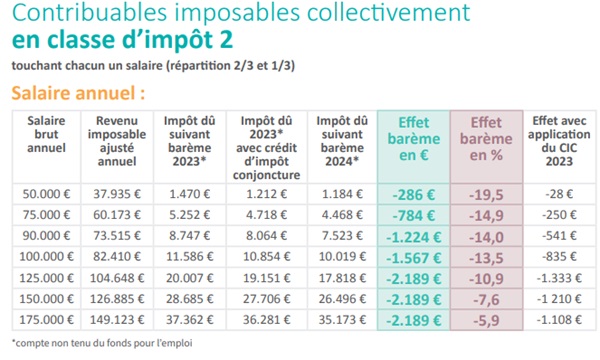

For a couple with a gross annual total of €125,000 (of which the salary of the first person represents 2/3 and that of the second 1/3), the effect compared to 2023 amounts to €2,189. Their tax burden will therefore decrease by 10.9%. Taking into consideration the CIC applicable in 2023, the effect amounts to €1,333.

A taxpayer in tax class 1a with an annual gross salary of €50,000 will have, thanks to the adaptation, €1,160 more in 2024. This corresponds to a reduction in the tax burden of 19.8%. Taking into consideration the CIC applicable in 2023, the effect amounts to €709.

This first adaptation of the tax scale provided for in the new government's coalition agreement is part of a broader approach to tax relief for households.