Credit: CSSF

Credit: CSSF

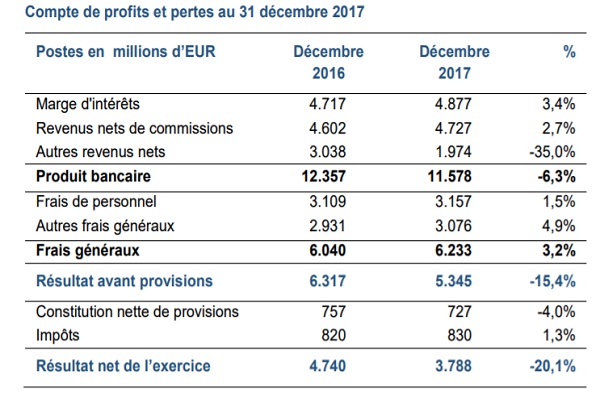

As of 31 December 2017, the result before provisions for the Luxembourg banking sector’s income was €5,345 million for the year 2017.

The CSSF has measured the result before provisions of the Luxembourg banking sector at over €5,000 million for last year. Compared with the 2016 financial year, the result before provisions decreased by 15,4% and the magnitude of this decline in annual comparison is largely related to an exceptional effect, resulting from the proceeds from the sale of a significant stake by a local bank at the end of 2016. These developments result in a decrease of 20.1% at the level of net profit for the year.

In 2017, the Luxembourg banking sector generated solid recurring banking income. In fact, the interest margin increased by 3.4% over one year. This favourable development was shared by 59% of Luxembourg banks, resulting in an increase in the volume of activities and in the average yield on assets or the passing on of negative interest rates by some banks to with regard to their institutional clientele. In addition, after a negative trend in 2016 (-2.5%), net commission income (+ 2.7%) stabilised again in 2017. Thus, 58% of banks in the marketplace benefited from a very favourable stock market context in relation to their asset management business on behalf of private and institutional clients.

The decrease in banking income (-6.3%) is due to other net income. In 2016, these revenues had risen sharply due to a significant capital gain made on an exceptional transaction by a bank in La Place. Excluding this exceptional effect, other net income would have decreased by 14.1% (instead of 35%) due in particular to a drop in dividends received by certain credit institutions.

The continuous increase in overhead costs has been a phenomenon observed for the last three years and affects the majority of Luxembourg credit institutions (64%). While part of the overhead is due to investments in new infrastructure, a significant portion of these costs is directly related to banks' compliance with a sustained flow of new accounting and regulatory standards. Other overheads amount to €3,076 million. For the year 2017, taxes and fees levied by Luxembourg banks to cover the costs and expenses of banking supervision amount to €16 million for the CSSF and €4 million for the European Central Bank.

The net result for 2017 is €3,788 million (-20.1%).