Credit: CSSF

Credit: CSSF

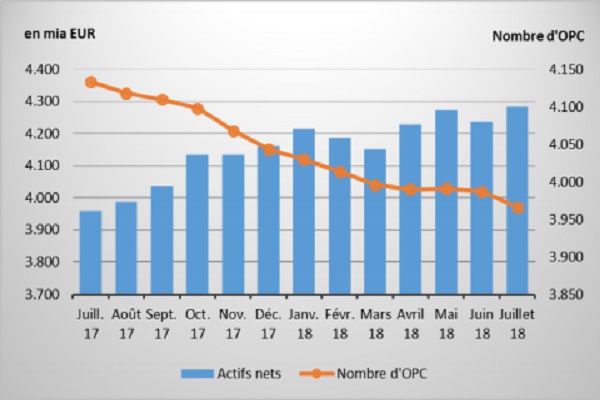

The Luxembourg undertakings for collective investment (UCIs) industry recorded a positive change in July 2018 amounting to €45.382 billion.

Taking into account the global situation of UCIs at the end of July 2018, Luxembourg has recorded the above increase, thus representing a balance of positive net issues up to €10.523 billion (0.25%) and favorable financial market developments of €34.859 billion (0.82%).

Globally, as of 31 July 2018, the aggregate net assets of UCIs amounted to €4,282.464 billion compared with €4,237,082 billion at the end of June 2018, an increase of 1.07% over one month. Over the past twelve months, the volume of net assets increased by 8.21%. Moreover, the number of undertakings for UCIs taken into consideration was 3,966 compared to 3,987 the previous month, whilst 2,573 entities adopted an umbrella structure representing 13,364 compartments. By adding 1,393 entities with a traditional structure, a total of 14,757 units are active in the financial centre.

With regard to the impact of the financial markets on the main categories of UCIs and net capital investment, the following facts can be noted for July. At the level of developed countries, the category of European equity mutual funds posted a positive performance following the easing of trade tensions between Europe and the United States, the stabilisation of economic indicators and the good results of companies in Europe. Likewise, robust growth in the United States and corporate earnings above expectations have closed the US equity fund class in positive territory. While Japanese stock prices have been supported by a generally favorable economic environment, and despite Japan's weaker economic indicators, the depreciation of the Yen against the Euro offset these gains.

Finally, in Europe and the United States, government bond yields rose slightly and investors have turned more to corporate bonds with the result that the risk premiums benefiting from these values have fallen slightly.