Credit: MFIN

Credit: MFIN

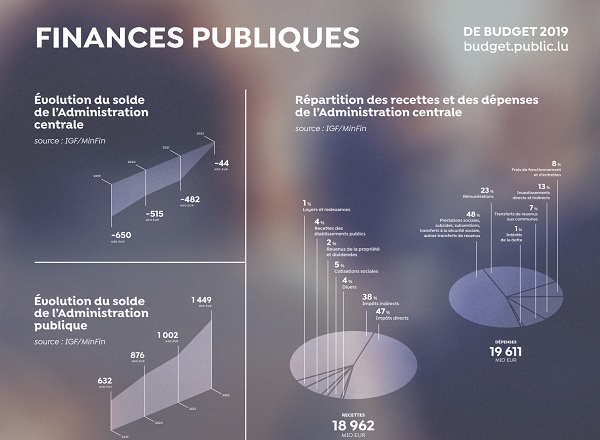

In 2019, central government expenditure in Luxembourg amounts to €19.6 billion, representing an increase of 5.8%.

Luxembourg Minister of Finance Pierre Gramegna today tabled in the draft law on the budget of state revenue and expenditure for the year 2019, as well as the draft law on the multiannual financial programme for the period 2019-2022, in the Chamber of Deputies.

The 2019 draft budget is set to reflect the priorities of the Luxembourg coalition government programme, namely foresight, sustainability, equity, social cohesion and competitiveness. Through this budget law, the government continues its ambitious policy on public investment and social measures. Among the flagship measures are the increase in the minimum social wage by €100 net per month and the increase in investments. Priority investments will include housing, education, research, digitalisation, transport infrastructure, sustainable energy, culture and social structures.

In application of the European Standard SEC 2010, the balance of the Public Administration for the year 2019 is €632 million, or 1% of GDP. This surplus is expected to increase throughout the period 2019-2022 to reach €1.4 billion in 2022, or 2.0% of GDP.

In 2019, 48% of central government expenditures are to bededicated to social benefits and income transfers, 23% to salaries and 13% to public investments. The receipts for their part amount to €18.9 billion, which corresponds to an increase of 1.6% compared to the year 2018. They are composed for 47% of direct taxes and 38% of indirect taxes.

Thus, the balance of the Central Administration is €-650 million in 2019. Over the next few years, it will gradually improve, returning to a level close to balance in 2022.

The trajectory of public finances will respect the medium-term objective (OMT) provided for by the European texts. While the OMT is set at -0.5% of GDP for 2019, the structural balance reaches 0.9% of GDP. For the period 2020-2022, the OMT is reattached to +0.5% of GDP. The structural balance will be 0.8%, 1.1% and 1.8% respectively for the years in question. The multiannual budget therefore remains at all times in line with European budgetary rules, with a margin of safety.

The "Draft Budget Plan 2018-2019", whose figures are based on those in the draft budget for 2019, confirms this observation of full compliance with the Stability and Growth Pact. This document is part of the economic and financial governance of the EU and will be forwarded to the European Commission following the presentation to the Chamber of Deputies.

Throughout the period 2019-2022 Luxembourg's public debt is estimated to remain one of the lowest in the European Union: 20.2% of GDP in 2019 (against 23.7% at the end of 2013). It is expected to fall to 18.4% of GDP in 2022.

The budget law also includes a series of fiscal measures designed to enhance social coherence, purchasing power and the competitiveness of enterprises, for instance the introduction of a minimum social wage tax credit (CISSM), to increase the minimum social wage, the application of the super-reduced VAT rate of 3% on hygienic products (tampons and sanitary towels) and e-books, the online press and other electronic publications. The Community Income Tax (CIT) rate will also be lowered from 18% to 17%, whilst the income bracket to which the CRI minimum rate of 15% applies will be increased from €25,000 to €175,000. This measure will primarily benefit young businesses and small and medium-sized businesses across the country.

Finally, as part of the fight against global warming, there are plans to increase excise duty of one cent per litre on gasoline and two cents per litre on diesel. The related revenues will be allocated, half to the Climate and Energy Fund and half to the State budget, to help finance the policies planned in the government programme, which puts a particular emphasis on measures for social cohesion.