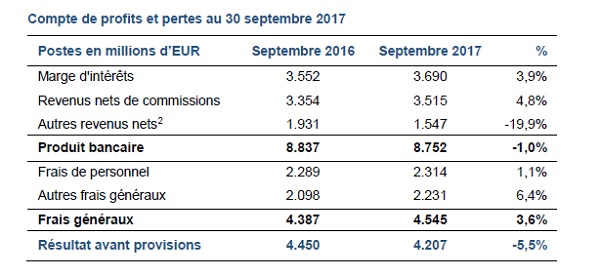

The Commission de Surveillance du Secteur Financier (CSSF), Luxembourg's financial regulator, has assessed the Luxembourg banking sector's result before provisions at €4,207 million for the first three quarters of 2017. Compared to the same period in 2016, the result before provisions decreased by 5.5%.

2017 Q3 was in line with the major trends already observed in the first half of 2017: recurring revenues - interest margin and net commission income - remained solidly up (+ 4.3%). while overheads continue to increase (+ 3.6%).

Interest rates increased by 3.9% on average. This favourable development, which affects 62% of Luxembourg banks, is triggered mainly by the increase in the volume of activities and the passing on of negative interest rates by some banks to their institutional clientele. As for the increase in net fee and commission income (+ 4.8%), it is shared by 55% of banks in Luxembourg. The increase is mainly attributable to asset management activities for private and institutional clients. However, this position is also progressing for the traditional banking intermediation trades.

As a result, the negative development observed at the level of the banking product is due to non-recurring effects and, in particular, linked to a significant decrease in the dividends collected for a limited number of credit institutions. In fact, other net income item fell sharply year-on-year (-19.9%).

The sharp increase in overhead costs is mainly due to the sustained increase in other overheads. This trend concerns the vast majority of banks in the financial center and reflects investments in new technical infrastructures, expenses due to extraordinary events as well as the costs to be borne by banks to comply with important new accounting standards. and regulations that will take effect in the coming months.

Due to the above developments, the result before provisions decreased by 5.5% in annual comparison.