The Microinsurance Network, based in Luxembourg, has called on the glaobal insurance industry to support UN sustainable development goals.

Insurance has a critical role to play in helping vulnerable people around the world manage their risks. As a financial shock absorber and an enabler of economic activity, insurance is most effective when complemented by risk-reducing strategies and measures that help prevent losses in order to make insurance solutions more accessible, affordable and sustainable. This was agreed by microinsurance experts from across the globe at the annual member meeting of the Microinsurance Network last week in the Grand Duchy of Luxembourg. The meeting was opened by Romain Schneider, Luxembourg's Minister for Development Cooperation and Humanitarian Affairs, who highlighted the government of Luxembourg’s ongoing commitment to supporting financial inclusion worldwide.

“Insurance and development experts must recognise that insurance is a critical enabler if we are to attain many of the United Nations’ Sustainable Development Goals (SDGs),” emphasised Katharine Pulvermacher, the newly appointed Executive Director of the Microinsurance Network. The Network is the only global platform that brings together stakeholders from across the insurance value chain, comprising policymakers, regulators, donors, the private sector and non-profit insurance organisations of all sizes, as well as other industry players, in an effort to mitigate the risks faced by poor households across the world.

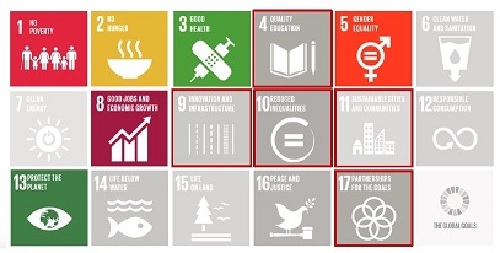

“A recent study by GIZ has identified six SDGs to which insurance fulfils a primary role in target achievement,” explained Solveig Wanczeck, Project Manager at the German Agency for International Cooperation (GIZ). “These are no poverty, no hunger, good health, gender equality, good jobs and economic growth, and protect the planet. Five more SDGs have been identified that rely on insurance playing a secondary role: quality of education, innovation and infrastructure, reduced inequalities, sustainable cities and communities, and partnerships for the goals,” she added. "Risk management and insurance at all levels – micro, meso and macro – are needed to build up the resilience that underpins the sustainable development agenda," underlined Veronika Bertram-Hümmer, Sector Economist at the KfW Development Bank.

“To help achieve the SDGs and the pledge ‘that no one will be left behind’, it is key for the insurance industry to work together with its stakeholders to deliver risk management services that help poor and vulnerable people better understand and reduce risk, and affordable insurance products that cater to their needs and circumstances,” said Butch Bacani, Programme Leader of UN Environment’s Principles for Sustainable Insurance Initiative (PSI), the largest collaborative initiative between the United Nations and the insurance industry, who spoke at the event. “With more than USD 30 trillion in global assets under management, it is also critical for the insurance industry to support economic, social and environmental sustainability as a major investor, including investments in low-emission technologies and climate and disaster-resilient infrastructure,” he added.

Supporting the development of the microinsurance sector entails the development of sector infrastructure, including research and data collection. One such initiative is the annual regional landscape study on microinsurance, through which the Microinsurance Network and the Munich Re Foundation have been gathering data to provide an industry benchmark since 2010, with results summarised in the world map of microinsurance. This online map enables sector practitioners to acquire a bird’s eye view on the state of microinsurance worldwide and gain insights into sector trends, fostering better decision making at an operational and policy level.

“The Microinsurance Network calls on the global insurance industry to deepen its engagement in inclusive insurance and looks forward to exploring how we can collectively better support efforts to achieve the 2030 global development vision,” concluded Pulvermacher.

Based in Luxembourg, the Microinsurance Network is the international multi-stakeholder platform for microinsurance experts to work together and focus on key areas for development in the sector. Its mission is to promote the development and delivery of effective insurance services for unserved people by encouraging shared learning and facilitating knowledge generation and dissemination.