Credit: KPMG-ABBL Private Banking Report

Credit: KPMG-ABBL Private Banking Report

KPMG Luxembourg and the Private Banking Cluster (PBGL) of the Luxembourg Bankers' Association (ABBL) have published a new edition of their joint Private Banking Report, which aims to identify significant trends and to raise awareness of the sector's different business models and their relative performances and weight.

In a challenging global environment, KPMG Luxembourg and the ABBL deemed it an important time to assess the health and outlook of the Grand Duchy's private banking sector. The story turned out to be one of "remarkable resilience", they found: the third edition of this joint annual survey concluded that the sector was "thriving" despite "undeniably tough" economic, market and recruitment conditions.

"Helping our members to better understand the challenges facing their businesses is one of the ABBL's main missions. [T]he PBGL offers industry leaders a unique platform for critically analysing the evolution of the business models of private banks operating in the Luxembourg market, as well as the priorities for continuing to strengthen Luxembourg as a 'domicile of choice' for wealthy clients. Surveys such as the one we have just conducted with KPMG are extremely valuable decision-making tools in this context," explained Fabio Mandorino, PBGL's coordinator.

Some of the key indicators from the 2022 financial year included the following:

• new net money of €31.7 billion (compared to €45 billion for Swiss private banks);

• all four different models studied (private banks that are part of universal banking groups, boutiques with or without branches across Europe, and specialist wealth management firms) are demonstrating that they can be successful in adverse conditions;

• Luxembourg's private banks are evolving to keep pace with clients' demands, illustrated by increased investment opportunities in private equity and private debt.

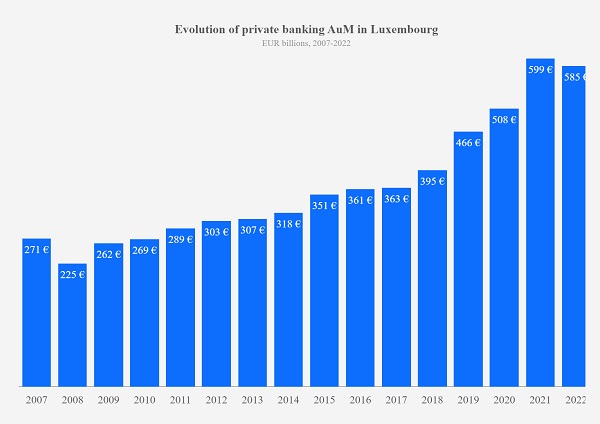

The headline figures remained positive despite global economic turbulence, according to the report. Although total assets under management declined by 2.3% in 2022, as a result of falling equity and bond markets, it proved to be a "solidly profitable" year for Luxembourg's private banking sector, with net income up by 24% (mainly due to increased net interest margin).

"Luxembourg private banks, large and small, are punching above their weight - they continue to demonstrate their resilience, resourcefulness and international appeal," said Anne-Sophie Minaldo, partner and head of regulatory services at KPMG Luxembourg. "A multi-year focus on technology, outsourcing and cost control has paid off - for the bottom line, and for clients who want a fully integrated face-to-face and digital service."

Assets under management stood at €585 billion (down 2.3% from €599 billion in 2021), with a decrease of 8% in market movements but an increase of 5% in net inflows. Moreover, despite rising costs, the average cost-income ratio dropped to 70%.

ABBL CEO Jerry Grbic noted: "The European banking sector plays a strategic role in ensuring Europe's competitiveness, growth and independence. In its core, Luxembourg's private banks play a decisive role, protecting and growing the assets of thousands of European families and entrepreneurs and channelling flows of private funds available to finance our economies. To enable our members to play this role to the full, it is vital to maintain a level playing field in terms of both regulation and taxation across the EU. Completing this single capital market and removing all de jure and de facto barriers is therefore at the heart of the ABBL's advocacy work."

Even though 2022 was a successful year for Luxembourg's private banks, there is "no room for complacency", noted KPMG Luxembourg and the ABBL, adding that the sector is "evolving fast". Mergers and acquisitions are continuing at pace as universal banks streamline their operations and re-book client assets from their European hubs in Luxembourg - an effect that has been amplified by the relocation of business to EU jurisdictions after Brexit, according to the report.

Meanwhile, all players appear to have benefited from technological advances. Automation and outsourcing have made private banks more efficient, freeing up frontline and other experienced staff to focus on clients rather than administration, found the report. As such, hybrid models that combine in-house compliance specialists with third-party providers of other functions are expected to remain a long-term pattern.

Another trend mentioned in the report was increased regulatory requirements, especially on transparency, and growing client preferences for green and sustainable investments, which will lead to additional costs.

"Patchy data, concern about greenwashing and the sheer speed at which new green investments are coming to market will be a major focus for cost, operational and compliance leaders in the years ahead," noted KPMG's Anne-Sophie Minaldo.

To access the KPMG Luxembourg and ABBL Private Banking Cluster's full report, visit https://kpmg.com/lu/en/home/insights/2023/10/private-banking-survey-2023.html.