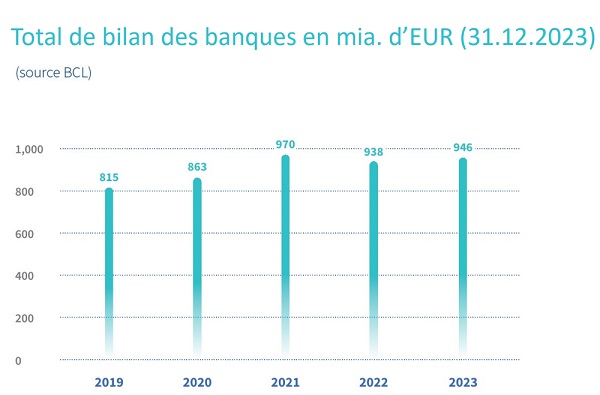

Bank balance sheet total;

Credit: BCL (graphic provided by ABBL)

Bank balance sheet total;

Credit: BCL (graphic provided by ABBL)

On Monday 22 April 2024, the Luxembourg Bankers' Association (ABBL) presented its activity report and the results of the banking sector for 2023.

The ABBL noted that it took several measures, together with its members, in 2023 to address the concerns of households and businesses in the areas of mortgages, opening business accounts and cybersecurity, in an uncertain context.

The association's annual press conference on Monday provided an opportunity to give details of these initiatives and to review the banks' "exceptional" results, which were mainly attributed to the more favourable conditions for the replacement of liquidity with the Central Bank.

The conference followed the ABBL's General Meeting, at which Yves Stein, CEO of Banque Edmond de Rothschild (Europe) SA, was elected ABBL Chairman, succeeding Guy Hoffmann, who was ineligible for re-election after six years in office. Mr Hoffmann will now take on the role of Vice-Chairman.

The ABBL recalled that 2023 was marked by the rapid and significant rise in key interest rates by the European Central Bank (ECB), which took many households and entrepreneurs by surprise and pushed some into difficulties with their loan repayments. "It should be remembered that the banks are not the cause of this rate rise but are merely an instrument in the ECB's fight against inflation," explained Guy Hoffmann.

Several voices also highlighted the difficulties encountered in opening accounts for legal entities. The ABBL added that the diversification and increasing complexity of online fraud attempts have also had an impact on customer confidence in banking services. "The housing crisis, the problems of opening business accounts and cybersecurity: as responsible players, we have a duty to respond to the concerns of our customers and the challenges facing our country," stressed Mr Hoffmann.

Housing

"Every bank wants to grant loans," explained ABBL CEO Jerry Grbic, "but every bank also has a dual responsibility. Firstly, towards the people who take out loans, by ensuring that they can repay them. And secondly, towards depositors, by ensuring that the assets they have entrusted to them are not jeopardised by an overly risky lending policy." The banks have therefore continued their cautious lending policy, framed by regulations that were further tightened in 2020. The production of loans fell due to a lack of demand and because a certain number of interested parties no longer met the conditions set out in the legislation, added the ABBL. The banks have introduced closer monitoring of cases in difficulty and have contacted their customers to find individual solutions.

The banks have also taken the initiative to help prevent a potential housing crisis, according to the ABBL. In 2020, the association approached the Commission de Surveillance du Secteur Financier (CSSF) to obtain greater flexibility and legal certainty for bridging loans. It also submitted recommendations to the political parties prior to the legislative elections and took part in the national roundtable on housing.

Opening business accounts

"We have identified three major challenges when it comes to opening accounts for legal entities", explained Camille Seillès, ABBL Secretary General. "The regulatory obligations to which banks are subject, particularly in terms of the fight against money laundering and the financing of terrorism; the complexity of certain structures, especially in the area of investment funds; and a sometimes incomplete view of the range of banking services available in the country to business startups and investors."

Together with its members, the ABBL acted on several fronts, for example developing educational communication tools with the ABBL Foundation for Financial Education, the Luxembourg Chamber of Commerce and the House of Entrepreneurship. The association added that it wants to help bring supply and demand closer together. It has drawn up a list of dedicated contacts within banks and other banking service providers potentially interested in integrating specific corporate segments. The association also stepped up its training initiatives, particularly for compliance officers, and it explored ways of pooling services.

Cybersecurity

"Unfortunately, we see that the human factor is often the weak link in successful online fraud scenarios," noted Ananda Kautz, Head of Innovation, Payments and Sustainability. "Fraudsters often convince victims to reveal their login details or access codes." The ABBL and its members, as well as the ABBL Foundation for Financial Education, are stepping up their initiatives to combat this scourge, for example through the extension of the services of the 491010 Hotline, now available 24/7 to report attempted fraud. 2023 also saw the launch of the "Sécher am Internet" platform, consolidated participation in European awareness campaigns and technological advances such as the migration of the GO6 Token to LuxTrust Mobile.

The press conference also provided an opportunity for ABBL officials to review the "exceptional" results achieved by Luxembourg banks, which recorded a 67.3% increase in profits in the 2023 financial year. "These results can be explained essentially by the liquidity that the banks are replacing with the Central Bank, as part of their prudential obligations. After a decade of low or even negative interest rates, and very low banking profitability, these investments are once again earning interest," explained Guy Hoffmann. To a lesser extent, reversals of provisions also had a positive impact on banks' profit and loss accounts.

As a corollary to these favourable results, direct taxes paid by the banks rose by 104.6%. "Banks paid more than €1.6 billion in direct taxes, making a significant contribution to the country's prosperity," he said. However, the outgoing chairman warned that these results would not be repeated this year, notably because of the rise in the cost of bank refinancing and the increase in provisions linked to bank risk management in a context of economic slowdown.

New ABBL Chairman Yves Stein painted a picture of the challenges and opportunities for the banking sector. The challenges relate in particular to the regulatory framework and attracting talent. "Banks must remain sustainably profitable and sustainably compliant," he said. "However, we have now reached a point where the scope of regulation has exceeded the capacity of both the industry and the supervisory authorities." The consequences, according to the ABBL, are a deteriorated customer experience and their alienation, as they no longer understand how this regulatory complexity benefits them. Luxembourg and European banks are also losing agility and competitiveness against their peers and find themselves limited in their ability to support the economy.

As reported by the ABBL, the issue of talent is "intimately linked" to the issue of regulatory amplitude. "In a context of increased competition between the private and public sectors, we need to be able to attract enough talent to help us manage this regulatory complexity. But we must also be careful not to demotivate this talent by entrusting them only with repetitive control tasks," added Mr Stein, who also expressed his hope that the ABBL and its members would continue to reflect on the issue of attracting talent and encourage the search for innovative solutions. "My wish is also for the banking profession to once again become inspirational for our children."

As for the opportunities, Yves Stein said he saw a "favourable window of opportunity" between a government whose declared will is to support the growth of the financial sector and a potential awareness at European level that the competitiveness factor should be considered in discussions on new regulatory developments. He added that he saw Luxembourg banks in a good position to play an active role in financing the digital and sustainable transition at European level.