On Wednesday 14 June 2023, the Luxembourg Private Equity & Venture Capital Association (LPEA) held its Annual General Meeting at which it reported membership growth of 28% in 2022, to 413 members from the Private Equity (PE) and Venture Capital (VC) markets.

The annual report for 2022 was presented and the association elected new board members for the coming year.

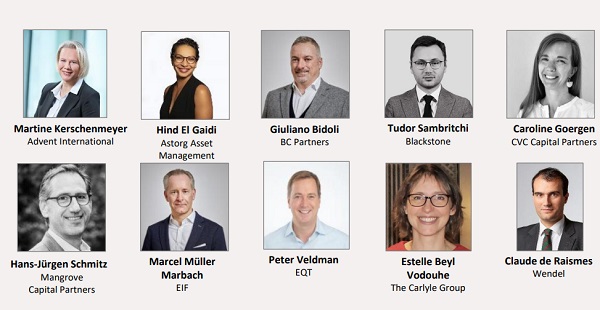

A total of ten new members were elected to the Board as part of the annual renewal of this governing body, including four new female representatives bringing women participation in the Board to 27%.

Stephane Pesch, CEO of the LPEA, was enthusiastic with the “continuous growth of the association which reflects the sector’s resilience and attractiveness of the LPEA to the industry professionals. Moreover, the number of new members that joined us already this year anticipates an even larger association by year-end".

As for Claus Mansfeldt, Chairman of SwanCap Investment Management S.A. and President of the LPEA, last year was highly impacted by macro-economic factors. Nonetheless, “the total value of completed deals in 2022 concluded well above pre-pandemic levels. In fact, 2022 was the second most active year of the last decade.”

To close the AGM, the LPEA invited two guest speakers from the European Investment Fund to present the Luxembourg Future Fund II. This public-private initiative is managed by the EIF and will deploy €200 million in hybrid debt equity, invest in VC funds or co-invest into Luxembourg-based SMEs.

The Luxembourg Private Equity and Venture Capital Association (LPEA) is the representative body of Private Equity and Venture Capital professionals in Luxembourg. With 451 members, LPEA plays a leading role in the discussions and development of the ecosystem and actively promotes the industry beyond the country’s borders. The Board of the LPEA is composed of 30 members and is due to elect 10 new Board Members annually for three-year terms.