Brent Crude Oil prices in USD and EUR;

Credit: STATEC

Brent Crude Oil prices in USD and EUR;

Credit: STATEC

On Friday 2 May 2025, Luxembourg's national statistics office, STATEC, published a report highlighting that while announcements regarding changes to tariffs are destabilising stock markets, the eurozone's financial centres appear to be less affected for the time being, as investors choose to reallocate their assets to European shores.

At the beginning of April, the US President outlined his "America First" trade policy by announcing a large increase in tariffs. The so-called “Liberation Day” tariffs sent shock waves through financial markets, fuelling inflationary fears (particularly in the United States) and a slowdown in growth. Since then, there has been a succession of reversals and retaliatory measures, exacerbating uncertainty for investors. This is reflected by the sharp rise in volatility indices for equities, bonds and currencies on the world's leading markets. The fear index (VIX), which measures the volatility of the S&P 500, rose to levels not seen since the beginning of the COVID-19 pandemic.

The report added that the loss of confidence in US financial assets could lead investors to favour assets in stable European countries. Luxembourg could benefit significantly from financial inflows. Luxembourg-domiciled investment funds recorded net asset inflows of €60 billion in the first quarter of 2025, a record for the last four years. Investment fund management is central to the country's business and its trade in financial services. Luxembourg could gain market share if exchange-traded funds (ETFs) investing in US equities - which are mainly domiciled in Ireland - experience investor withdrawals. Demand and supply of loans to businesses and households should benefit from a cut in key ECB interest rates.

STATEC stated that US consumers are worried about inflation. The consumer sentiment index compiled by the University of Michigan, which peaked last December, fell in April for the fourth consecutive month, returning to its lowest level since mid-2022. Households surveyed reported a fall in their view of the economic climate, as well as a clear upward trend in inflation expectations. Their one-year inflation expectations rose to 6.5% in April, the highest level since 1981, in the wake of the announced increases in US tariffs. Another reference household survey, the Conference Board Consumer Confidence Index, painted a similar picture. In its latest forecasts published on 22 April 2025, the International Monetary Fund revised its outlook for 2025 and 2026 significantly downwards, particularly for the United States. The US economy is set to expand by just 1.8% in 2025 (down 0.9 percentage points on the IMF's January forecasts) and 1.7% in 2026 (down 0.4 percentage points).

Furthermore, business surveys conducted among Luxembourg companies are reported to have delivered mixed signals in recent months. In the industrial sector, business confidence shows no clear trend at the start of 2025, but it is broadly in line with its long-term value. In the non-financial services sector, confidence deteriorated slightly between February and April in Luxembourg (the situation is similar in the eurozone), mainly as a result of downgrades in demand forecasts.

STATEC noted that in the in the fourth quarter of 2024, housing prices in Luxembourg rose by 1.1% over one quarter. Housing prices are showing annual growth for the first time since the end of 2022 (+1.4% year-on-year in the fourth quarter of 2024), but their level remains well below the peak reached in the third quarter of 2022 (by around 15%).

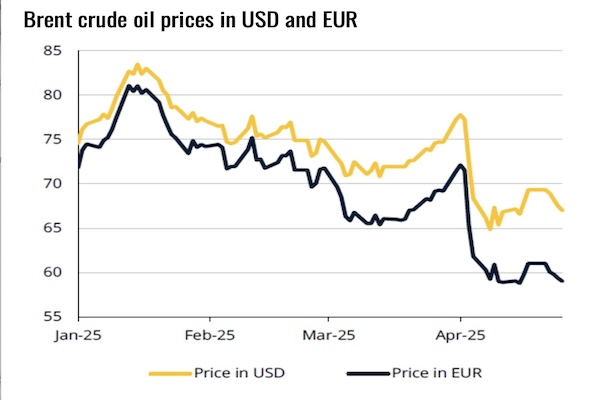

Concerning inflation, the day after "Liberation Day", the price of a barrel of oil plummeted and has remained at relatively low levels ever since. While the uncertainty surrounding US policy pushed up the price of gold (as a safe-haven asset), the price of "black gold" suffered from the deteriorating outlook for global activity and trade. Between 1 and 25 April 2025, the price of a barrel of Brent crude oil fell by 14% in USD terms (down 18% in EUR terms), given the simultaneous depreciation of the dollar (from 0.93 $/€ to 0.88 $/€ over this period). Despite the decline, this rate of inflation is sufficient to trigger a new indexation, with a 2.5% increase in wages, salaries and pensions coming into effect from Thursday 1 May 2025.

Looking at the labour market, STATEC reported that, after a sharp slowdown that began in 2022, employment growth has stabilised at around 1% year-on-year over the last three quarters of 2024 with a number of leading employment indicators pointing to a recovery in employment over the coming months.

Regarding energy, the report noted that imports of natural gas from the United States reached a record level in Europe in the first quarter of 2025. After a slight decline in the second half of 2024, the EU imported more than 18 bn m3 of US gas in the first three months of the year, representing around a quarter of its total gas imports. The United States is now the European Union's second-largest supplier of natural gas, behind Norway, which supplied 30% of European gas demand.

Public revenues collected in the first quarter of 2025 rose by 18% year-on-year (+3.4% quarter-on-quarter on a seasonally adjusted basis). This growth is largely due to corporation tax, which increased by 50% year-on-year and by 40% between the last quarter of 2024 and the first quarter of 2025, inflated by the tax balances of some companies relating to previous years. Household income tax fell by 5.5% over the quarter due to a drop in capital income and the effect of the adjustment to the tax scale. In addition, VAT revenues fell by 7% over the quarter (after having risen by 14% in 2024), registration duties and excise duties on fuels fell again (by -14% and -8% respectively over the quarter), while excise duties on tobacco continued to rise (+7%).