Employment and Unemployment in Luxembourg;

Credit: STATEC

Employment and Unemployment in Luxembourg;

Credit: STATEC

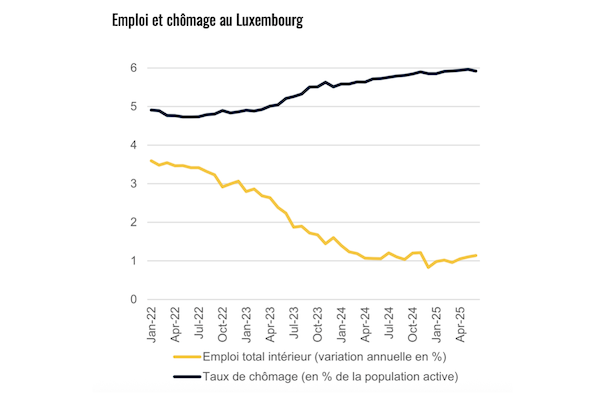

On Tuesday 22 July 2025, Luxembourg's national statistics institute, STATEC, published its latest Conjoncture Flash report, highlighting that the country’s labour market recovery remains weak despite a slight pickup in job creation in Q2 2025.

In its analysis, STATEC noted that employment grew by 0.3% quarter-on-quarter between April and June 2025, up from 0.2% in the first quarter. However, this pace remains subdued by historical standards, and a stronger acceleration would be needed to reach the projected 1.5% growth rate for 2026.

The public sector emerged as the main driver of employment growth in Q2 2025, accounting for 0.2 percentage points of the total 0.3% increase. Job gains were particularly notable in health and social work and public administration (each up 0.8% over the quarter), as well as in education (+0.5%). In the private sector, growth was supported mainly by transport and business services (each contributing 0.1 percentage points), while the construction sector continued to weigh negatively on overall job growth (-0.1 percentage points).

According to STATEC, the modest acceleration in private sector employment between the first and second quarters was primarily driven by business services, transport and the financial sector. While financial services had stagnated in previous quarters, they recorded a surprising uptick of +0.2% in Q2 2025 based on preliminary data. However, other areas, such as construction (-0.9%), household employment (-0.9%), information and communication technologies (-0.2%) and manufacturing (-0.1%), continued to decline.

Defence spending has also drawn renewed attention, particularly following the NATO summit in The Hague in June 2025, where member states committed to increasing their defence budgets to between 2% and 5% of GDP by 2035. As reported by STATEC, Luxembourg allocated just 0.6% of its GDP (0.8% of GNI) to defence in 2023, compared to 1.8% in France, 1.1% in Germany and 0.9% in Belgium.

Luxembourg’s defence budget continues to prioritise international partnerships, with 42% of expenditure in 2023 dedicated to foreign military aid. In contrast, only 30% was spent on personnel, the category most likely to benefit the domestic economy, reflecting the country’s limited armed forces. By comparison, Belgium allocated 57% of its military spending to salaries, while France and Germany also devoted larger shares (40% and 34%, respectively) and lower proportions to international aid (4% and 19%, respectively).

After a year of steady growth, mortgage lending to households in Luxembourg saw a slight decline of 2% in Q1 2025 (seasonally adjusted), according to STATEC. This dip may prove temporary, as early indicators point to renewed growth in Q2. Despite the slowdown, mortgage volumes remain approximately €500 million below pre-housing crisis levels in real terms. The previous rebound had been driven by falling interest rates throughout 2024. In early 2025, fixed mortgage rates edged up while variable rates continued to drop, resulting in long-term fixed rates once again exceeding variable ones for the first time in two years.

Services inflation in Luxembourg rose to 2.4% in June 2025, up from 1.7% in March, largely due to the May indexation and a sharp increase in travel-related costs. Package holidays saw a year-on-year rise of 7.4% in H1 2025, and airfares were up 5.8%, jointly contributing 0.2 percentage points to overall H1 inflation. Across the eurozone, prices for tourist packages, accommodation and transport services rose as well, with notable increases in Slovakia, Malta, Germany, Estonia, Croatia and Greece.

After rebounding in 2024, gas and electricity consumption in Luxembourg has shown signs of slowing. Gas consumption rose 1% year-on-year in H1 2025, though Q2 saw a decline. This earlier increase was mainly due to colder temperatures and higher industrial usage, which stabilised in 2025. Heating oil deliveries fell by 2%, potentially indicating a shift away from oil-fired heating systems. Electricity consumption, up 2% in 2024, slowed to less than 1% in H1 2025, with recent months showing declines. While residential prices rose early in the year, over 80% of electricity consumption comes from businesses, limiting the overall price impact.

STATEC reported a continued decline in fuel sales, which has impacted Luxembourg’s tax revenue. Between January and April 2025, total fuel sales dropped nearly 4% year-on-year, driven by a more than 7% decrease in diesel. This trend reflects the shrinking number of diesel vehicles - down by one-third since 2019 - and a narrowing price gap with neighbouring countries due to Luxembourg’s rising CO₂ tax. For professional diesel, prices are now lower in Belgium and France. In contrast, petrol sales increased by 6%, largely due to the growth in hybrid vehicles, which typically run on petrol alongside electric power.