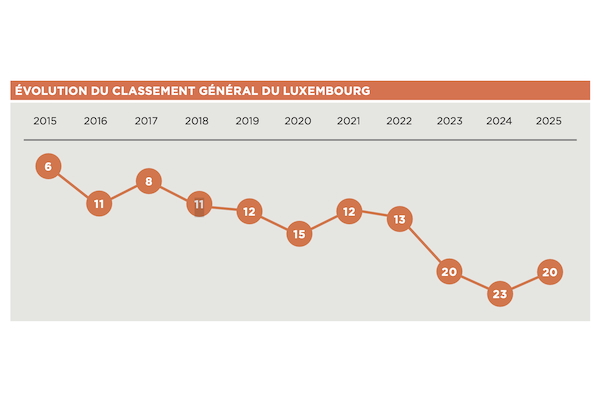

Luxembourg's World Competitiveness rankings from 2015 to 2025;

Credit: Luxembourg Chamber of Commerce

Luxembourg's World Competitiveness rankings from 2015 to 2025;

Credit: Luxembourg Chamber of Commerce

On Tuesday 17 June 2025, Luxembourg’s Chamber of Commerce published Luxembourg’s results from the World Competitiveness Yearbook 2025, which showed the Grand Duchy rise to 20th place.

The report, published by the International Institute for Management Development (IMD), noted a rise from 23rd place in 2024 to 20th place in 2025, halting a downtrend which had persisted since 2022. In its report, the Chamber of Commerce said: “The Grand Duchy continues to be outpaced by former peers such as Germany and Australia, slipping into what analysts call the ‘soft underbelly’ of the global competitiveness rankings. This marks the third consecutive year in this mid-tier zone, suggesting a long-term structural repositioning.”

The ranking for 2025, based on four pillars - economic performance, government effectiveness, business efficiency and infrastructure - saw Luxembourg fail to make the top 15 of the rankings, where it had previously held its place every year until 2022.

Under Pillar 1, “Economic Performance”, Luxembourg's economy remains strained due to domestic demand and employment issues. After falling to 57th place in 2024, the country climbed 22 spots to 35th in 2025. Despite this improvement, growth remains sluggish at 1%, placing Luxembourg 48th in GDP growth. Notably, Luxembourg now trails Singapore in GDP per capita on a purchasing power parity basis.

International investment also continues to show volatility, employment growth is low and youth unemployment is notably high. Despite topping the global GDP per capita rankings, the Grand Duchy is among the least competitive in terms of cost of living, housing prices and fuel costs, reflected in its 56th-place ranking for prices.

According to the report, the biggest setback lies in sustained inflationary pressures and deteriorating price competitiveness. Even as inflation remained moderate at 2.25%, housing and fuel prices continued to weigh heavily on residents and businesses. The report noted that these persistent structural weaknesses point to deeper economic imbalances that cannot be corrected through short-term gains in trade or finance alone.

Luxembourg’s results for Pillar 2, “Government Effectiveness”, showed that Government effectiveness remains a strength for the Grand Duchy but the country’s ranking for this aspect dropped from 11th to 14th in 2025, marking its worst performance since 2018.

Public finances are regarded as “sound”, with Luxembourg ranked 9th for debt and 10th for deficit, but serious concerns persist about the long-term sustainability of its pension system (38th) and an uncompetitive tax policy (49th), where high business and income taxes continue to draw negative attention

Institutionally, Luxembourg remains strong, ranking 13th overall for its institutional landscape. However, areas such as administrative complexity, labour regulations and a weakening perception of competitiveness in capital markets were highlighted as issues.

The report observed that while the country’s political stability is considered to be a clear asset and that, societally, Luxembourg ranked highly in gender income equality (3rd) and maintained a robust social environment (10th). However, inequality levels remain a concern (30th on the Gini coefficient) and the government's ability to implement reforms efficiently is under growing scrutiny.

For Pillar 3, “Business Efficiency”, the report saw Luxembourg’s business efficiency ranking improve marginally to 23rd, with high labour productivity (1st) and overall productivity (2nd) were marked as standout strengths. However, productivity growth is seen as weakening (61st), signalling potential stagnation, despite improvements in SME and large-company efficiency.

While Luxembourg leads in employment-to-population ratios, the report revealed the impact of skilled labour shortages (57th) but, notably, the country had improved in attracting high-skilled talent (4th) and international management experience (7th). The report said that challenges do remain in senior talent availability and gender diversity at higher management levels. It regards these as critical gaps Luxembourg must aim to improve to future-proof its workforce.

Financially, Luxembourg’s strengths in banking asset share and mergers and acquisitions activity are tempered by weaker stock performance (65th) and difficulty accessing credit (56th). Managerial practices showed positive trends - particularly in risk-taking, responsiveness to market shifts and Big Data usage - but the country still lags behind in agility and diversity.

Under Pillar 4, “Infrastructure”, Luxembourg remains in 24th place, thanks to its “world-class” education system (3rd) and strong basic infrastructure (14th). Rail network density, urban management and air transport were noted in the report as excellent but physical constraints, such as market size (68th) and land area (66th), inherently limit the country’s competitiveness, particularly in the areas of logistics and distribution.

Despite registering a strong rating for internet access, technological infrastructure is regarded as a weak link (44th). Declines were noted in key areas such as bandwidth speed, cybersecurity integration and legal support for technological development. The report said that these drops threaten the Grand Duchy’s ambitions to become a digital and cybersecurity hub and the scarcity of qualified engineers (54th) also limited the country’s innovation and tech sector growth.

In scientific and health infrastructure, Luxembourg performed well in patent output and research and development spending but lagged behind neighbouring countries in broader research performance. Environmentally, Luxembourg ranked high in water efficiency and emission control but scored poorly on ecological balance (65th) and competitiveness of environmental laws (46th). However, education remains a clear competitive advantage for the country, with top scores in student spending, low illiteracy and foreign student attraction.

Based on the findings within the report, the Chamber of Commerce defined the following Key Competitiveness Challenges for Luxembourg in 2025:

- intensify defence efforts as part of a comprehensive economic and industrial strategy;

- create a fully integrated ecosystem around artificial intelligence to remain competitive in emerging tech;

- ensure long-term sustainability of the social security system, especially pensions;

- attract and retain top talent, particularly in high-skilled and tech-driven sectors;

- guarantee competitive energy costs while advancing the energy transition.