Euro area GDP in volume;

Credit: Eurostat

Euro area GDP in volume;

Credit: Eurostat

On Wednesday 26 November 2025, STATEC published its latest economic update highlighting the resilience of activity in the euro area in the third quarter (Q3) of 2025, alongside mixed but overall positive signals for the Luxembourg economy.

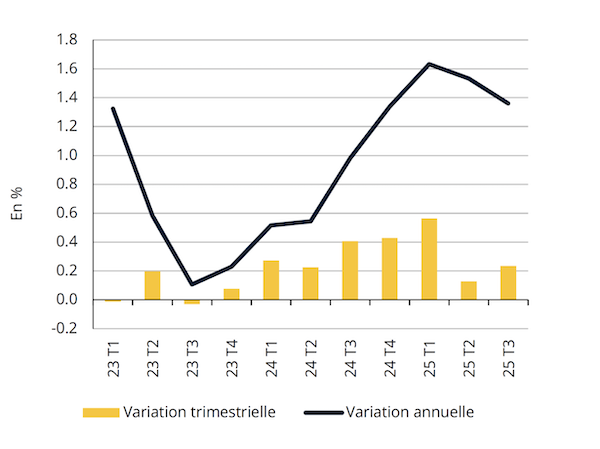

According to this report, euro area GDP in volume grew by 0.2% quarter-on-quarter in Q3 2025 (+1.3% year-on-year), a result slightly above expectations, largely thanks to stronger-than-anticipated growth in France. While divergences between Member States remain significant, the overall performance now points to a stronger expansion for 2025 than had been expected earlier in the year.

STATEC noted that France stood out with GDP growth of +0.5% over the quarter, compared with expectations of +0.2%. This positive surprise is mainly attributed to exports of transport equipment, particularly in aeronautics, and higher corporate investment in manufactured goods and information and communication services.

Spain and Portugal continued on a solid growth path in Q3 2025, with GDP rising by +0.6% and +0.8% respectively, driven in large part by robust domestic demand. Germany and Italy narrowly avoided a technical recession, recording stagnation after slight declines in Q2. In Germany, a rebound in investment in machinery and equipment was offset by a negative contribution from net exports, while in Italy, foreign trade supported growth but inventory reduction weighed on activity.

For the full year 2025, the latest forecasts cited by STATEC (from the European Commission, IMF and Oxford Economics) now point to euro area growth of around 1.2-1.4%, compared with significantly lower projections published in spring.

After rising sharply during the financial and sovereign debt crises and then gradually declining from 2014 onwards, unemployment in the euro area has stabilised at around 6.3% since the beginning of 2025. STATEC underlined that Spain and Greece still record some of the highest unemployment rates in the bloc, whilst Finland has seen a marked rise in joblessness since the start of the war in Ukraine.

Spain, Italy and Greece continue to see a gradual reduction in the number of job seekers. By contrast, Germany and France have experienced a renewed increase in unemployment since 2023, a trend that has strengthened in 2025. In Luxembourg, the unemployment rate began to rise again in 2022 but has stabilised in recent months at around 6.0%.

The international context remains marked by trade tensions, particularly with the United States, and by shifts in sovereign risk assessments. STATEC reported that France’s sovereign rating was downgraded by both Fitch and S&P Global Ratings in autumn 2025, against a backdrop of political tensions, a high budget deficit and rising public debt. This downgrade is expected to increase borrowing costs and reduce the attractiveness of future French sovereign bond issues.

Belgium’s rating, which remains two notches above that of France, was placed on a negative outlook due to increased risks surrounding fiscal consolidation and economic vulnerability. Germany and Luxembourg have retained their top AAA ratings with stable outlooks, supported by strong and transparent institutional and budgetary frameworks.

Conversely, southern European countries have seen notable improvements in their ratings: one notch for Italy and Portugal and two notches for Spain. According to STATEC, these upgrades reflect improved external positions, the accelerated rollout of the EU’s NextGenerationEU plan and resilient economies backed by robust labour markets. This improvement has also translated into narrower sovereign bond spreads vis-à-vis Germany since the beginning of 2025.

In Luxembourg, building permit data show a clear reduction in the average size of planned dwellings since 2022, for both houses and apartments. STATEC explained that buildings classified as “with two or more dwellings” also include certain mixed-use projects, which artificially raise the average size figure in this category.

The reduction in dwelling size is likely linked to the sharp increase in mortgage interest rates in recent years, which has significantly raised the cost of home purchases for households. STATEC observed that the adjustment in the new-build market has occurred not only via lower selling prices (around -3.5% in both 2023 and 2024) but also via smaller average surface areas.

For new apartments specifically, sales data show that the average floor area of units sold under construction has been around 77 m² since 2023, compared with about 82 m² on average over the previous decade. In the first half of 2025, this average fell further to 71 m², the lowest level recorded so far.

STATEC reported that new housing loans granted by banks in Luxembourg surged in June 2025, as households rushed to benefit from temporary housing-related tax relief before its expiry at the end of the month. Demand weakened during the summer but picked up again in September. Overall, new housing loans increased by 25% year-on-year over the first three quarters of 2025, whereas consumer credit fell by 4%.

Loans to non-financial corporations granted between January and September increased by almost 30% compared with the same period in 2024, although they remain about 25% below their level at the beginning of 2022, prior to the monetary tightening cycle. According to the bank lending survey cited by STATEC, the rebound in corporate lending mainly reflects refinancing and debt restructuring needs. Banks have at the same time tightened lending criteria for small and medium-sized enterprises, notably due to capital requirements under the CRR III framework.

For the fourth quarter of 2025, banks expect a stabilisation in loan demand from both households and businesses.

In Q3, Luxembourg investment funds (UCIs) recorded a 6.5% year-on-year increase in net assets. This rise stems largely from a rebound in equity valuations (+ €159 billion quarter-on-quarter), supported by improved investor expectations regarding US trade and monetary policy, global growth and investments in artificial intelligence (despite growing concerns about high valuation levels and market concentration). According to the CSSF, Latin American and Asian equities achieved the strongest performances, while European equities posted more modest gains due to mixed economic prospects in Germany and political instability in France.

Net subscriptions increased significantly (+ €79 billion quarter-on-quarter), reaching their highest level since 2021 in August. This rise in capital investments, affecting both equity and fixed-income fund categories, is expected to support the sector’s value added in real terms in Q3.

On the domestic labour market, STATEC highlighted that employment growth in Luxembourg has gained momentum. After quarterly growth of +0.3% in both Q1 and Q2 2025, total employment rose by +0.5% in Q3, a stronger-than-expected outcome. This acceleration concerns both resident workers (+0.4%) and cross-border commuters (+0.5%).

By sector, business services made a significant contribution to this improvement, in particular temporary employment (which had fallen sharply in Q1 and Q2) and building and landscaping services. The public sector remained the main job creator in Q3 2025. The construction sector continued to contract overall across the quarter, but the decline was much less pronounced than previously; monthly data even show slight employment gains in August, September and October.

Job vacancies also picked up again in September and October, notably in business services, the financial sector and construction.

After the partial phasing-out of government measures that had capped electricity and gas prices, households in Luxembourg saw their bills increase in 2025 compared to 2024 (by around 30% for electricity and 10% for gas). However, STATEC reported that electricity supply tariffs for households are expected to fall by around 15% at the beginning of 2026.

This expected decrease will be driven by a government decision to cover about one third of the electricity network charges for both households and businesses, through a budget envelope of €150 million, combined with lower wholesale procurement costs for suppliers. According to STATEC, these elements should more than offset the expiry of remaining crisis-related support schemes.

Fossil fuel prices are also projected to decline in 2026, despite a further increase of €5 per tonne in the CO₂ tax from 1 January 2026 (to €45/t). Forecasts point to price reductions of around 7% for gas, 3% for heating oil and petrol and 2% for diesel, mainly due to expected declines in natural gas and crude oil prices on international markets.