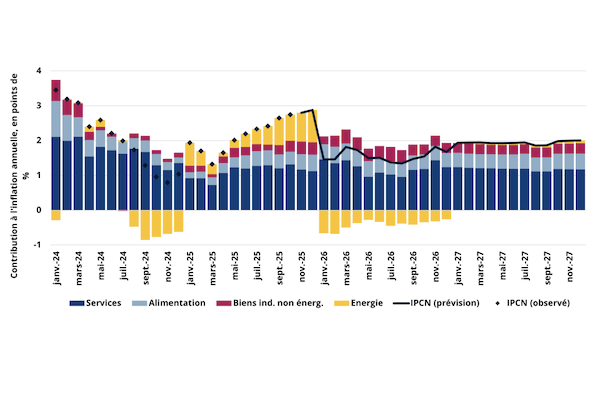

Annual inflation rate and contributions (forecasts as of 05/11/2025);

Credit: STATEC

Annual inflation rate and contributions (forecasts as of 05/11/2025);

Credit: STATEC

On Wednesday 5 November 2025, Luxembourg’s statistics institute STATEC published its updated inflation forecast.

STATEC noted that consumer price growth in Luxembourg was relatively strong in the third quarter of 2025, forecasting inflation in Luxembourg at 2.2% for 2025 but expecting the rate to fall to 1.5% in 2026 as a result of expected stabilisation of energy prices, particularly electricity prices.

STATEC reported that over the past few months, inflation has been largely fuelled by positive base effects on energy prices, which had fallen a year earlier. It reached 2.7% year-on-year in October, with energy prices rising 11.7% over one year (compared with -10.8% a year ago). These prices accounted for more than a quarter of total inflation in October (0.8 percentage points, half of which was attributable to electricity, which had risen substantially in January).

Annual inflation for services in Luxembourg rose in October (+2.6% year-on-year), while pressure on food prices eased (+2.0% year-on-year in October, compared with +2.5% in August 2025). Annual core inflation remained relatively stable at +2.5% in October (after +2.4% in September).

According to these forecasts (which constitute STATEC's central scenario), the next wage indexation would apply in the third quarter of 2026, with the next tranche in the third quarter of 2027.

In the euro area, inflation fell slightly from 2.2% in September to 2.1% in October (according to a preliminary estimate), indicating a gradual convergence towards the ECB's 2% target. In Luxembourg, inflation in services remained buoyant (+3.4% in October, compared with +3.2% in September), while food inflation slowed (from 3.0% in September to 2.5% in October). On the other hand, energy prices continued to fall (-1.0% year-on-year in October), extending the persistent decline observed since March.

STATEC noted that the main international institutions are consolidating their inflation forecasts for the eurozone at around 2.1% in 2025. For 2026, inflation is expected to range from 1.5% (Oxford Economics) to 2% (OECD), with forecasts factoring in the expected dissipation of energy shocks.