Serge Weyland, ALFI CEO;

Credit: Steven Miller, Chronicle.lu

Serge Weyland, ALFI CEO;

Credit: Steven Miller, Chronicle.lu

On Thursday 12 February 2026, the Association of the Luxembourg Fund Industry (ALFI) hosted a media breakfast event at Terro House in Luxembourg-Ville, where it presented details on Luxembourg’s fund industry’s priorities for 2026, including regulatory, market and technology developments, as well as detailing ALFI’s key events for the year ahead.

The event began with an introduction from ALFI Head of Communications, Luigi Salerno, who welcomed the assembled members of the media (including Chronicle.lu) and the event’s speakers, ALFI CEO Serge Weyland, ALFI Deputy CEO and General Counsel Corinne Lamesch and ALFI Chief Marketing Officer Britta Borneff. He then announced that ALFI will hold its Global Asset Management Conference in March 2026 and its Private Assets Conference in November 2026.

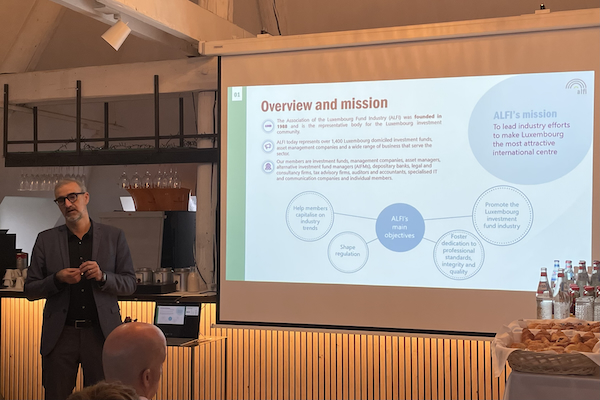

Serge Weyland then provided a brief overview of ALFI’s structure and its mission representing the face and voice of the Luxembourg asset management and investment fund community. He noted that since the association was founded in 1988, it has grown to accommodate over 40 full-time equivalent employees and now boasts 1,400 members. He highlighted that despite ALFI working alongside the Luxembourg Government, it was not the recipient of government funding and that it was fortunate to have enough members supporting it financially.

Serge Weyland said: “We have over 100 working groups where members engage with ALFI team members and develop industry guidance and best practices, because we want to make sure also that we protect the reputation of Luxembourg as a financial centre.”

He added: “We have different committees with the CSSF (Commission de Surveillance du Secteur Financier), which we attend as ALFI. We [also] have strong ties also with the Ministry of Finance, commenting on upcoming regulation and also helping them in defending the interests of Luxembourg at the European level and moving forward the dialogue at the European level.”

He then touched on various subjects including artificial intelligence (AI), tokenisation and wider fund access for citizens. On the latter, he said: “This is really something that we have set ourselves as an objective. And we count also on you [the media] to help us with that effort, because we believe that our new citizens in Luxembourg, generally speaking, need to understand the benefits also for them in investing. We know that a lot of the money, savings money, still sits in savings accounts and cash accounts and that actually translates into a loss of purchasing power for our citizens.”

Serge Weyland then talked of the advantages of investing in Luxembourg over other countries such as the United States and the desire to follow certain models used in other countries such as Sweden, Denmark and Japan, who’s legislation allows tax savings on specific investment and pension structures which do not currently exist in Luxembourg. In particular, he emphasised the growing need to adjust the pension framework in Luxembourg due to its inability to generate competition and the low yields the current products offer.

A key aspect of Serge Weyland’s presentation was the European Commission’s recent proposals on investment and savings accounts and revising supervision of asset management, market infrastructure and cryptocurrencies, as well as the proposal for additional powers for the European Securities and Markets Authority (ESMA). He remarked that ALFI’s biggest concern is that by introducing this centralisation it might hamper innovation in asset management going forward as ESMA would be tasked with defining standards, procedures and templates for approving funds and products.

He said: “We are trying to find the right balance of ensuring more convergence at the European level, but at the same time maintaining the innovation and the agility of the asset management space. It is less about protecting Luxembourg than protecting the interests of the industry because we think if those proposals go through, we feel that we might see that the European asset management industry will be weakened.”

Following a brief Q&A session with the audience, Corinne Lamesch spoke of the upcoming vote on IFMD2 (the EU’s update to AIFMD - Alternative Investment Fund Managers Directive), which will bring a harmonised regime for loan originating funds, as well as other changes such as rules on liquidity management tools and additional reporting requirements on delegation.

Corinne Lamesch said: “It is little changes, but it just shows we are adjusting our toolbox on an ongoing basis and so we do that for the private asset sector, but also the UCITS (Undertakings for Collective Investment in Transferable Securities) sector and ETFs (Exchange-Traded Funds) which is really our focus there. I think that is something which I think is a positive thing. We have been really happy with the developments in Luxembourg, the new ideas. It's often only little adjustments for our toolbox but at the end of the day [these] make big differences.”

On the subject of overseas opportunities for the Luxembourg fund industry, Britta Borneff highlighted ALFI’s involvement in a number of global seminars in 2025, including, for the first time, a working visit to Mumbai (India) and the upcoming Global Asset Management Conference, where new markets to Luxembourg such as South America will be represented by the Argentinian Fund Association and as well as representatives from other countries.

Britta Borneff said: “There are opportunities in other regions of the world and we need to, or we want to be, visible there as well. It is through seminars and bilateral meetings with fund associations and regulators that we are trying to keep an eye out on what is happening and have that dialogue to see what opportunities and what bridges can be built for the benefit of Luxembourg.”