Credit: Swissquote Bank Europe

Credit: Swissquote Bank Europe

On Thursday 30 October 2025, Luxembourg-based online bank Swissquote Bank Europe published the results of its second annual Luxembourg Wealth Survey, conducted in partnership with the Luxembourg Institute of Research and Opinion Polls (ILRES), examining residents’ perceptions of wealth, financial security and investment behaviour.

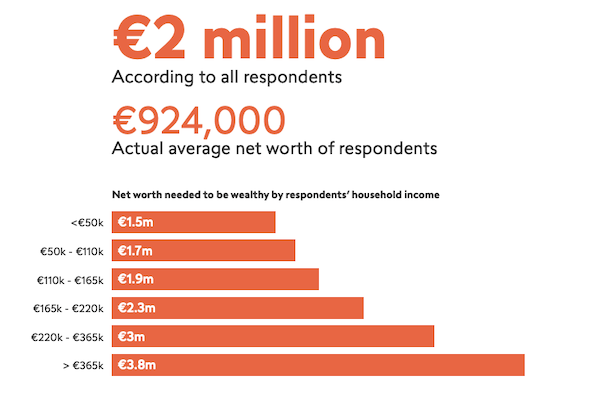

The survey found that feeling wealthy in Luxembourg now requires a €2 million net worth, with top earners setting the threshold at €3.8 million, among the highest benchmarks in Europe. Compared with 2024, wealth sentiment has softened, with nearly half of respondents reporting stable finances and 31% feeling less wealthy.

Confidence in the state pension system remains divided: nearly half of residents expect sufficient retirement income, while 41% fear shortfalls, leading to increased reliance on personal savings and investments. Meanwhile, geopolitical tensions have overtaken inflation as the main perceived threat to personal finances in 2025, cited by 59% of respondents.

Inheritance (62%) and property investment (59%) were identified as the most reliable ways to build wealth, ahead of high-paying jobs and financial market investments.

According to Swissquote Bank Europe Chief Commercial Officer Jeremy Lauret, the findings reflect shifting financial attitudes: “While Luxembourg residents continue to set some of Europe’s highest wealth benchmarks, we see a growing focus on personal responsibility and diversified income sources.”

The results are based on responses from 1,697 Luxembourg residents surveyed between 20 April and 2 May 2025, including Swissquote clients and ILRES panel participants.