Development of UCIs in Luxembourg;;

Credit: CSSF

Development of UCIs in Luxembourg;;

Credit: CSSF

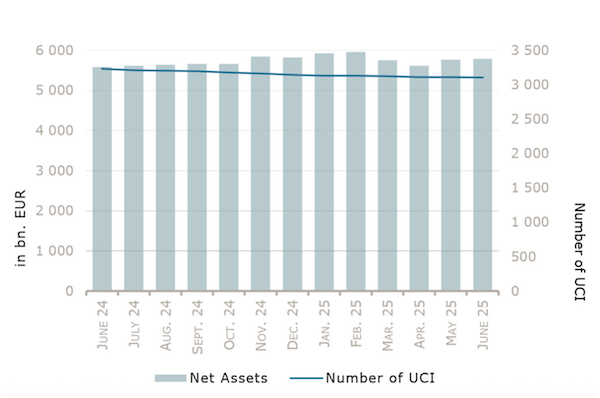

The Commission de Surveillance du Secteur Financier (CSSF) has reported that as of 30 June 2025, the total net assets of undertakings for collective investment (UCIs) in Luxembourg stood at €5,787.186 billion (€5.79 trillion).

This marked an increase of 0.38% compared to the previous month’s €5,765.403 billion. Over the past twelve months, net assets have grown by 3.67%. The monthly growth of €21.783 billion was attributed to positive net capital investments of €27.282 billion (0.47%) and the negative development of financial markets amounting to €5.499 billion (-0.09%).

The total number of UCIs slightly decreased to 3,104 (down from 3,107 in May). Of these, 2,057 entities used an umbrella structure representing 12,357 sub-funds. Adding the 1,047 entities with a traditional UCI structure brings the total number of active fund units in Luxembourg’s financial centre to 13,404.

According to the CSSF, June's financial market performance was shaped by uncertainty surrounding US fiscal policy and geopolitical tensions following a brief direct confrontation between Israel and Iran. While this triggered market volatility, a rapid ceasefire restored sentiment, with equity markets rebounding, particularly in tech and AI-related stocks, despite adverse currency movements.

Equity UCI categories experienced net capital outflows, especially in US, Asian and Latin American equities. On the bond side, credit spreads narrowed and yields diverged between Europe (up) and the US (down). Most fixed income categories showed negative performance, but USD money market funds attracted inflows.

During the month in question, eight new UCIs were registered on the official list:

Undertakings for Collective Investment in Transferable Securities (UCITS) Part I 2010 Law: Global Capital Fund (Munsbach)

Undertakings for Collective Investment (UCIs) Part II 2010 Law: HPS Credit Solutions Master SCSP (Luxembourg City); HPS Credit Solutions SICAV SA (Luxembourg City); Invesco Private Markets SICAV (Luxembourg City); MAM SCA, SICAV (Luxembourg City); Mercer Private Markets SA SICAV-UCI Part II (Luxembourg City); Siera Impact Fund (Luxembourg City)

Specialised Investment Funds (SIFs): Premium Selection SIF SICAV (Luxembourg City)

Conversely, eleven UCIs were removed from the official list:

UCITS Part I 2010 Law: Infusive UCITS Fund (Luxembourg City); Jupiter Investment Fund (Bertrange); OLB VV-Optimum (Frankfurt am Main)

UCIs Part II 2010 Law: PE-Invest SICAV (Senningerberg)

SIFs: AB Private Credit Investors Middle Market Direct Lending Feeder Fund, SICAV-SIF SCSP (Luxembourg City); AB Private Credit Investors Middle Market Direct Lending Fund, SICAV-SIF SCSP (Luxembourg City); ALX SICAV-SIF (Luxembourg City); Amethis Maghreb Fund I SICAV-FIS SCA (Luxembourg City); Aream Sustainable Infrastructure SCA, SICAV-FIS (Munsbach); Keystone Fund (Luxembourg City); Mercura Lux (Luxembourg City).