Rental Analysis Photo;

Credit: JLL Research 2025

Rental Analysis Photo;

Credit: JLL Research 2025

On Tuesday 2 December 2025, JLL, a global commercial real estate and investment management company, announced the results of a study on the impact of free public transport on Luxembourg’s office market.

Data shows that the opening of the first tram section in 2017, followed by extensions to Findel and Howald in 2025, fundamentally changed mobility. The planned extensions by 2035, combined with railway network modernisation aims to continue creating a dense and efficient network covering the entire country. The cornerstone of this proactive policy was free transport for everyone starting in 2020, making Luxembourg the first country to introduce free nationwide public transport.

JLL BeLux’s Research department analysed all office transactions since 2020, focusing on buildings located within a ten minute walk of a tram or train station.

Key findings shows that:

- Of the 1.3 million m² of office transactions signed since early 2020, 71% were located within ten minutes of public transport (tram or train);

- Average transaction sizes along tram corridors exceeding the market average by 59%;

- The average transaction size along public transport routes exceeds the average size of transactions not served by tram or train by 210%;

- This correlation is reinforced by the fact that 70% of take-up between 2020 and the first half (H1) of 2025 consisted of new developments (existing Grade A or prelettings), that are predominantly situated along the T1 tram line.

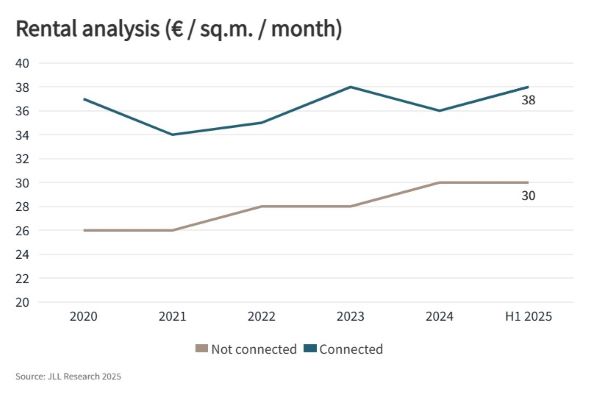

In the second phase of the analysis, JLL compared average rents for buildings along the tram corridor with those not connected to public transport. The study shows, that rents in buildings located along tram or train routes are around 30% higher than those in areas not connected to public transport. However, this result requires context, as the highest rents are typically found in new buildings, which in recent years have been largely concentrated in locations served by tram or train.

In terms of conclusions for future developments, JLL noted that developers have long recognised that locations with strong public transport and road connections offer the best prospects for attracting tenants. However, while access to public transport remains essential, it does not replace the need for high-quality and sustainable buildings.

Moreover, JLL’s study indicates that central districts continue to show very low vacancy rates and high rents. At the same time, secondary locations are increasingly viewed as credible alternatives, particularly when they benefit from direct and fast public transport connections.

Two districts stand out: Cloche d’Or, including its Howald extension, and the Findel airport district.

In Cloche d’Or, the tram extension has encouraged several companies to relocate from the Central Business District (CBD) or Kirchberg, including State Street, Intesa San Paolo and Baker McKenzie. The effect is even more pronounced in Howald, which previously faced high vacancy rates. The tram project, combined with new high-quality developments, has increased rents and attracted tenants such as Cardif Lux Vie from the CBD.

The Findel airport district has also changed significantly. Now connected to Kirchberg and Luxembourg City centre by tram, the district has shifted from structural vacancy to becoming a competitive alternative to central locations. The opening of the Skypark project, which includes multiple services and a hotel, has attracted major tenants such as Deutsche Bank. Since 2020, rents have risen by 28% and vacancy has decreased, despite the speculative delivery of Skypark.

JLL's study highlighted the real beneficial impact of the tram on Luxembourg's office market, both from a demand and rental value perspective. However, developers cannot ignore the equally pressing requirement for building quality and sustainability. The combination of these factors has enabled the development and success of previously underperforming districts that now have a promising future, concluded JLL.

EO