Luxembourg placed second in Moorepay's international rankings, with a pension surplus calculated at €15,948 (£13,823) per annum;

Credit: Moorepay

Luxembourg placed second in Moorepay's international rankings, with a pension surplus calculated at €15,948 (£13,823) per annum;

Credit: Moorepay

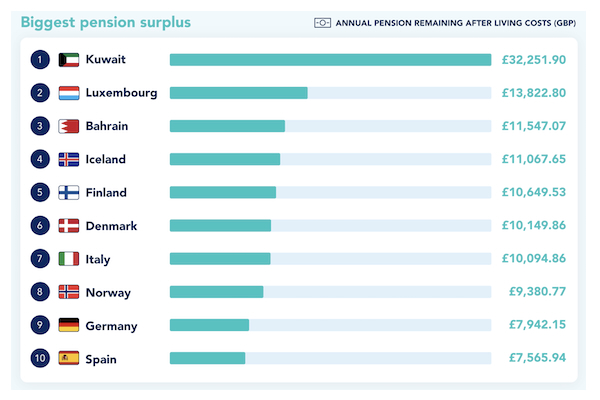

On Wednesday 14 January 2026, payroll and human resources company Moorepay published the results of its study into the value of state pensions worldwide, with Luxembourg featuring among the strongest performers.

Moorepay said its analysis highlighted the Grand Duchy’s relatively generous public retirement provision when measured against living costs. The analysis compared state pension payments with estimated basic expenses across multiple countries, offering insight into how well retirees are supported in different jurisdictions.

According to the Moorepay guide, the Luxembourg state pension covers approximately 225% of average basic living costs. This placed Luxembourg second in the international rankings, with a pension surplus calculated at €15,948 (£13,823) per annum. Moorepay said this reflected both comparatively high pension payments and the structure of Luxembourg’s social security system, which is funded through contributions from employees, employers and the state.

Moorepay remarked that the results are relevant at a time when Luxembourg continues to debate the long-term sustainability of its pension model. Although current pension levels remain strong, demographic trends point to an ageing population and a growing ratio of retirees to active workers.

However, Moorepay’s analysis also highlighted that Luxembourg remains one of the most expensive countries in Europe, particularly for housing and services, eroding the real purchasing power of pension income. In this context, Moorepay again highlighted the significance of Luxembourg’s pension reforms.

The study also drew attention to the importance of supplementary pension arrangements in Luxembourg. Occupational and private pension schemes play a key role in complementing the state pension, particularly for higher earners and cross-border workers. Together, these pillars shape overall retirement income and influence how international rankings translated into lived experience.

Moreover, Moorepay said that Luxembourg’s position in its global pension comparison reinforced the country’s reputation for strong social protection while also highlighting the need for careful policy management, with its findings suggesting that maintaining generous pension coverage will depend on balancing demographic realities, economic growth and ongoing reform to ensure the system remains viable for future generations.

The full report can be viewed at https://www.moorepay.co.uk/the-ultimate-guide-to-global-state-pension/.