China's trade balance in goods;

Credit: STATEC/Chinese Customs

China's trade balance in goods;

Credit: STATEC/Chinese Customs

On Tuesday 27 January 2026, Luxembourg’s national statistics institute, STATEC, published its latest Conjoncture Flash report showing that China recorded a historic trade surplus in 2025, while Luxembourg remained only moderately exposed to Chinese imports.

According to STATEC, this result stems from a combination of factors, including diversification of export markets, weak imports due to subdued domestic demand and the circumvention of United States (US) customs duties through third countries.

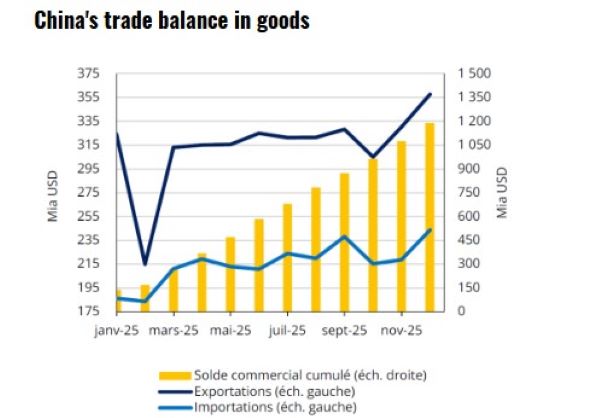

Figures show that China’s trade surplus in goods reached $1.188 trillion (€1.093 trillion) in 2025, up from $992 billion (€913 billion) in 2024. Exports increased by 5.5%, while imports stagnated due to weak domestic demand. China achieved this result despite higher United States (US) customs duties, which weighed on bilateral trade with its main export partner.

Higher tariffs reduced China’s trade surplus with the US market by 22%, from $360 billion (€331 billion) in 2024 to $280 billion (€258 billion) in 2025. In response, China diversified its export markets. Between 2024 and 2025, its goods trade surplus increased by 26% with Europe, 29% with Latin America and 39% with Asia.

Asia played a dual role as both an additional export market and a transit region, according to STATEC. China benefited from strong economic growth and expanding middle classes in countries such as India, Indonesia and Malaysia to absorb excess production.

According to the report, China routed part of its production through third countries to bypass US tariffs. Imports from China to Vietnam and Thailand rose by more than 20%, reaching nearly $200 billion (€184 billion) and $103 billion (€95 billion), respectively, in 2025. Exports from these countries to the US increased by $46 billion (€42 billion) for Vietnam and $20 billion (€18 billion) for Thailand.

STATEC data show that China remains a secondary trading partner for Luxembourg. Chinese goods accounted for around 3% of Luxembourg’s total imports by value, placing China among the country’s ten largest suppliers. However, China represented 20% of Luxembourg’s imports of electrical, audio and video equipment during the first ten months of 2025, up from 3% over the same period in 2024.

Luxembourg continued to run a significant trade deficit with China, importing goods worth €922 million while exporting €346 million, mainly valves and copper sheets, resulting in an overall trade defecit of €576 million.

According to STATEC, Luxembourg households’ financial assets continued to grow. In the third quarter of 2025, household financial wealth increased by 5.2% year-on-year and 0.7% quarter-on-quarter. Households mainly increased bank deposits (+4.4%) and investments in shares and life insurance. Bank deposits accounted for 40% of households’ financial assets, compared with 29% on average in the euro area.

Data indicated that the housing prices declined by 3.1% quarter-on-quarter in the third quarter of 2025, following a strong increase in the previous quarter. On an annual basis, prices still increased by 1.2%. The number of housing transactions fell sharply during the quarter but increased by 23% year-on-year, following a surge in activity earlier in the year linked to the planned expiry of temporary support measures.

On the labour market in Luxembourg, employment growth accelerated in the third quarter of 2025 and maintained a quarterly increase of 0.5%. At the same time, unemployment rose to 6.2% of the labour force in November-December, compared with 5.9% at the end of the summer.

Public finances also showed a shift in trend. Taxes collected on household income declined by 2.6% in 2025, marking the first decrease since 2009 after fifteen consecutive years of growth. Withholding taxes on wages and salaries increased by 1.7%, reflecting slower employment growth and the impact of tax relief measures introduced under the “Entlaaschtungs-Pak” (“Relief Package”).